Navigating Commission Payments After Termination in California

Commission payments are a common part of compensation for many employees, especially in sales and similar industries. In California, understanding how these payments work is crucial, particularly when it comes to termination. The law in California provides specific guidelines on how commissions are handled, ensuring that employees receive what they are owed. This article will guide you through the ins and outs of commission payments, focusing on what happens after termination and the different types of commission agreements you might encounter.

What Happens to Commission Payments Upon Termination

When an employee is terminated, whether voluntarily or involuntarily, questions often arise about their unpaid commission. In California, employees have rights regarding commissions even after their employment ends. Here’s a quick overview of what happens:

- Unpaid Commissions: Employees are entitled to receive any earned but unpaid commissions up to their termination date.

- Commission Structure: If your commission structure is based on achieving specific targets, you may still be entitled to a portion of your commission if you met those targets before your termination.

- Payment Timeline: Employers must pay any outstanding commissions in accordance with the state’s wage payment laws, usually in the next scheduled pay period.

- Final Paycheck: The final paycheck should include all earned wages, including commissions, and it must be provided to the employee on their last working day if terminated involuntarily.

Types of Commission Agreements

Commission agreements can vary widely based on the nature of the business and the role of the employee. Here are some common types:

| Type of Agreement | Description |

|---|---|

| Straight Commission | Employees earn a percentage of sales without a base salary. |

| Base Salary Plus Commission | Employees receive a fixed salary along with commissions based on sales performance. |

| Tiered Commission | Commission rates increase as sales goals are met or exceeded. |

| Draw Against Commission | Employees receive an advance on future commissions, which is deducted from future earnings. |

Each of these agreements has its own set of rules and potential implications for commission payments upon termination. It’s essential to understand the specific terms outlined in your contract.

Legal Obligations of Employers

In California, employers have specific legal obligations regarding commission payments, especially when it comes to employee termination. These obligations are designed to protect employees and ensure they receive fair compensation for their work. Understanding these legal requirements can help both employees and employers navigate the complexities of commission payments more effectively.

Here are the primary obligations that employers must fulfill:

- Paying Earned Commissions: Employers are required to pay any commissions that have been earned by the employee up until the termination date. This includes both fully earned commissions and any prorated amounts for partial sales.

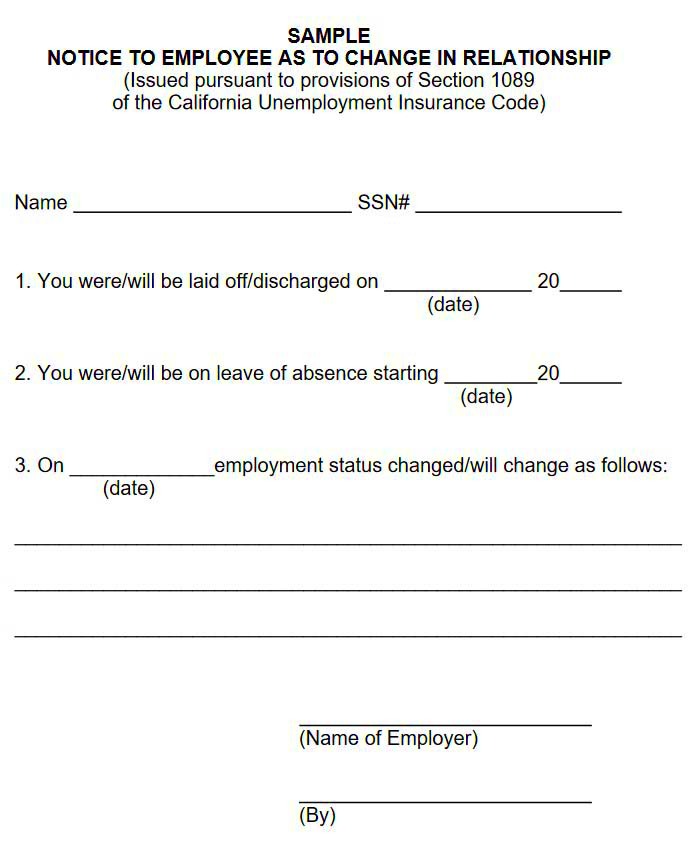

- Providing a Written Agreement: California law mandates that employers provide a written commission agreement that outlines the commission structure, including how and when commissions will be paid. This agreement should be clear to avoid disputes.

- Timely Payments: Employers must ensure that any unpaid commissions are included in the employee’s final paycheck. The timing of this payment is also crucial, as it must comply with California’s wage payment laws.

- Clear Communication: Employers must communicate the terms of the commission structure and any changes to employees clearly. Lack of communication can lead to misunderstandings and disputes.

Employee Rights Regarding Commissions

Employees in California have specific rights concerning their commission payments, which are protected by state law. Knowing these rights can empower employees to advocate for themselves when it comes to unpaid commissions or disputes with their employers. Here are some essential rights that employees should be aware of:

- Right to Earned Commissions: Employees are entitled to receive commissions that they have earned, even if their employment is terminated.

- Right to a Written Agreement: Employees have the right to receive a written commission agreement that clearly outlines the terms, conditions, and expectations related to their commissions.

- Right to File a Claim: If commissions are unpaid, employees have the right to file a claim with the appropriate authorities, such as the California Labor Commissioner’s Office.

- Protection from Retaliation: Employees are protected from retaliation for asserting their rights regarding unpaid commissions, which means they cannot be fired or discriminated against for seeking their due payments.

Filing a Claim for Unpaid Commissions

If you believe that you are owed unpaid commissions, it’s essential to understand the process of filing a claim. While it can seem daunting, knowing the steps can make the process much smoother. Here’s how you can file a claim for unpaid commissions in California:

- Gather Evidence: Collect all relevant documentation, including your commission agreement, pay stubs, and any correspondence with your employer regarding the unpaid commissions.

- Contact Your Employer: Before filing a claim, it’s a good idea to reach out to your employer to discuss the issue. Sometimes, disputes can be resolved through direct communication.

- File a Claim: If direct communication does not yield results, you can file a claim with the California Labor Commissioner’s Office. You can do this online or by submitting a paper application.

- Attend a Hearing: In some cases, a hearing may be scheduled where you can present your evidence. Be prepared to explain your situation clearly and provide all necessary documentation.

- Receive a Decision: After reviewing the evidence, the Labor Commissioner’s Office will issue a decision regarding your claim. If you are awarded unpaid commissions, your employer will be required to pay you.

Filing a claim may seem intimidating, but it’s an essential step in ensuring you receive the compensation you’ve earned. Remember, you have rights, and it’s crucial to stand up for them.

Potential Legal Consequences for Employers

Employers in California must take commission payments seriously. Failing to comply with state laws regarding commissions can lead to significant legal consequences. Understanding these potential ramifications can encourage employers to ensure they are meeting their obligations and treating employees fairly.

Here are some of the legal consequences employers may face:

- Legal Claims: Employees may file claims for unpaid commissions, leading to legal action against the employer. This can result in costly legal fees and settlements.

- Penalties: Employers who do not pay earned commissions may face penalties, including fines imposed by the California Labor Commissioner’s Office.

- Interest on Unpaid Wages: Employers may be required to pay interest on unpaid commissions, which adds to the total amount owed.

- Retaliation Claims: If an employee files a complaint about unpaid commissions, any retaliatory action taken by the employer could lead to additional claims and legal trouble.

- Reputational Damage: Legal disputes can harm a company’s reputation, making it harder to attract and retain talent.

Given these potential consequences, it’s crucial for employers to ensure they have clear commission agreements and that they adhere to California laws regarding payment of commissions.

Frequently Asked Questions

It’s common to have questions about commission payments and your rights as an employee in California. Here are some frequently asked questions to clarify your understanding:

| Question | Answer |

|---|---|

| Can my employer withhold my commissions after I’m terminated? | No, employers are required to pay any earned commissions, even if you are terminated. |

| Do I need a written agreement for my commissions? | Yes, California law requires a written commission agreement that outlines the terms clearly. |

| What should I do if I believe my commissions are unpaid? | Contact your employer first. If unresolved, file a claim with the California Labor Commissioner’s Office. |

| Can I be retaliated against for filing a claim? | No, you are protected from retaliation for asserting your rights regarding unpaid commissions. |

Conclusion

Navigating commission payments after termination in California can be challenging, but understanding your rights and obligations is essential. Employees have specific rights to ensure they receive the commissions they’ve earned, while employers have legal responsibilities to fulfill. By staying informed about the commission structures and legal obligations, both parties can work together to avoid disputes and ensure fair compensation.

If you find yourself in a situation involving unpaid commissions, don’t hesitate to seek guidance and take action. Remember, your rights matter, and standing up for them is crucial in securing the compensation you deserve.