New Mexico Business Regulations: What You Need to Know

New Mexico boasts a rich cultural heritage and a thriving business landscape. If you’re considering launching a venture in this state you’ll encounter a blend of time honored and contemporary regulations aimed at assisting and safeguarding entrepreneurs. Navigating these rules can significantly impact whether your journey is seamless or fraught with challenges. From establishing your business to staying compliant with tax and employment laws every aspect plays a role in ensuring the smooth operation of your enterprise.

In New Mexico the rules for businesses are in place to make sure that companies run smoothly and securely. These rules involve things like registering your business getting licenses paying taxes and so on. The goal is to support businesses growth while also protecting the public and the environment.

Business Registration Requirements

To start a business in New Mexico you need to follow a few steps to make sure everything is on the up and up. The initial step is to get your business name registered. You can accomplish this by submitting a name (also known as a “doing business as” name) to the New Mexico Secretary of State.

Next, it’s time to decide on the structure of your business. You can go for a sole proprietorship, partnership, limited liability company (LLC) or corporation. Each type comes with its own rules for registration.

- Sole Proprietorship: Generally the simplest form, it doesn’t require formal registration beyond your trade name.

- Partnership: Requires filing a partnership agreement and trade name registration.

- LLC: Must file Articles of Organization with the Secretary of State and create an Operating Agreement.

- Corporation: Requires filing Articles of Incorporation and creating bylaws.

Lastly, get an Employer Identification Number (EIN) from the IRS. This number is essential for tax matters and setting up a business bank account.

Key Licensing and Permit Obligations

After registering your business it’s essential to tackle the licensing and permit necessities. These differ depending on the nature of your business and where it’s located. For instance if you’re starting a restaurant you’ll require permits from the health department food handling permits and potentially a liquor license if you intend to serve alcohol.

Here’s a rundown of the permits and licenses you may require.

- Business License: Most businesses in New Mexico require a general business license from the city or county where you operate.

- Professional Licenses: If you’re providing professional services like accounting, legal advice, or medical care, you’ll need specific licenses from state boards.

- Sales Tax Permit: Required if you’re selling goods or services subject to sales tax.

- Health Permits: Necessary for businesses in the food industry to ensure compliance with health and safety regulations.

Getting the licenses and permits isn’t only about following the rules; it’s also about positioning your business as a reliable and reputable player. Going through this process safeguards your venture and your clients, laying a solid groundwork for your entrepreneurial path.

Tax Responsibilities for New Mexico Businesses

Dealing with taxes can be overwhelming, particularly if you’re just starting out in the business world. It’s essential to know your tax duties in New Mexico not only to stay compliant but also to ensure the well being of your business. Being aware of these responsibilities can save you from unexpected situations and enable you to handle your finances more efficiently.

In New Mexico it is important for businesses to stay informed about a few crucial tax responsibilities.

- Gross Receipts Tax: This is one of the primary taxes for New Mexico businesses. It’s not a sales tax, but a tax on the gross revenue of your business. Depending on your business type and location, the rate can vary, so checking with the New Mexico Taxation and Revenue Department is essential.

- Income Tax: Businesses must file federal income tax returns and, depending on their structure, state income tax returns. Corporations pay a corporate income tax, while LLCs and sole proprietors report income on their personal tax returns.

- Withholding Tax: If you have employees, you’ll need to withhold state income taxes from their paychecks and remit these to the state. Additionally, you must file quarterly reports to keep track of these withholdings.

- Property Tax: Businesses that own property need to be aware of property taxes. The value of your business property will be assessed, and taxes will be based on this valuation.

Maintaining meticulous records and staying informed about tax rules can help you avoid expensive mistakes. When I launched my venture I was caught off guard by the intricacies of tax regulations. Having a reliable accountant by my side proved invaluable as they guided me through the process and steered me clear of potential traps. Seeking counsel can greatly impact how you handle your taxes.

Employment Laws and Regulations

Navigating employee management can be tricky, particularly when it comes to adhering to employment laws. New Mexico has regulations in place to safeguard the interests of both employees and employers. Familiarizing yourself with these laws is crucial for establishing a workplace that is fair and in line with legal requirements.

Here are some important labor regulations that you should familiarize yourself with.

- Minimum Wage: New Mexico has its own minimum wage requirements, which can be higher than the federal minimum wage. As of now, New Mexico’s minimum wage is set to increase gradually, so staying updated is important.

- Employee Classification: It’s crucial to correctly classify your workers as either employees or independent contractors. Misclassification can lead to legal issues and fines.

- Workers’ Compensation: New Mexico law requires most businesses to carry workers’ compensation insurance. This insurance covers medical expenses and lost wages for employees who are injured on the job.

- Employment Discrimination: New Mexico law prohibits discrimination based on race, color, religion, sex, national origin, age, disability, and other protected categories. Ensuring a fair hiring process and workplace environment is crucial.

In my view creating a work environment that is both respectful and within the bounds of the law is not just about following rules; it also contributes to a positive company culture. I remember a time when communicating about employment policies helped prevent potential conflicts from escalating. Ensuring that your employees are well informed and treated fairly promotes a workplace.

Health and Safety Standards

Creating a workplace is not only about following the rules but also about doing the right thing. In New Mexico companies are required to meet health and safety standards to safeguard their workers and clients. By putting these standards into action accidents can be avoided and adherence to regulations can be ensured.

Here are some important health and safety regulations for businesses in New Mexico.

- Occupational Safety and Health Administration (OSHA) Compliance: Businesses must comply with OSHA regulations, which cover a wide range of workplace safety issues, from machinery safety to emergency preparedness.

- Workplace Safety Programs: Implementing safety programs, such as regular safety training and emergency response plans, is essential. These programs help prepare employees for potential hazards and ensure they know how to respond in emergencies.

- Health Regulations: For businesses in the food industry or other health-sensitive sectors, adhering to specific health regulations is critical. This includes proper sanitation practices and regular health inspections.

- Ergonomics: Providing ergonomic equipment and training can prevent workplace injuries related to repetitive stress and poor posture.

Looking back on my beginnings in the world of business I came to understand that taking an approach towards health and safety not only fulfills legal obligations but also uplifts the spirits of employees. When staff members observe that their well being is valued it positively impacts their efficiency and commitment to the company. Consistently assessing and refreshing your health and safety protocols keeps you proactive in addressing challenges and upholding a workplace.

Environmental Regulations

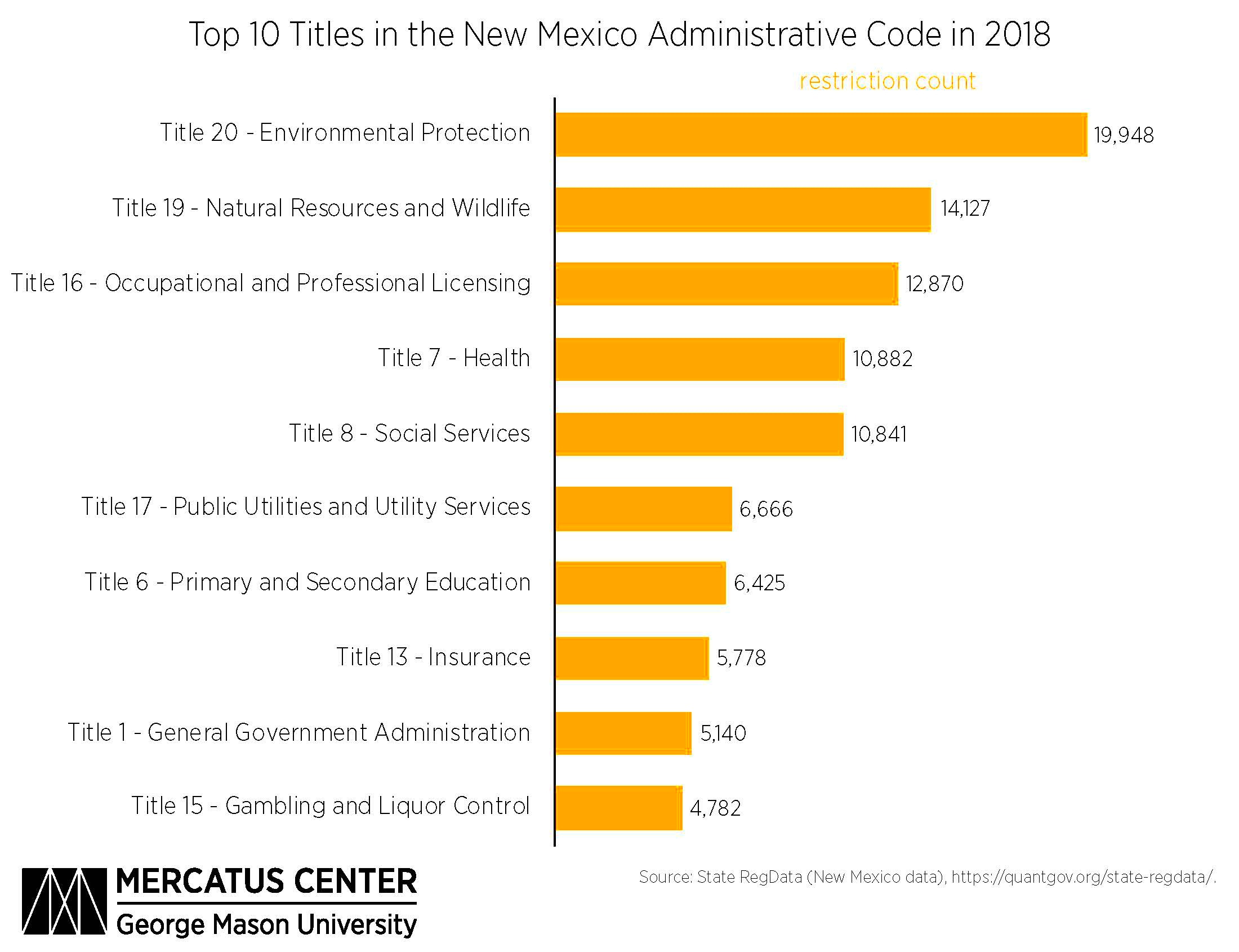

In the world of business the focus is often on profits and growth while the environment gets overlooked. However that’s not how it should be. In New Mexico environmental regulations go beyond just following the rules they show a dedication to protecting the states natural beauty and resources. These regulations play a role in making sure that companies conduct their operations in a manner that is both eco friendly and accountable.

Take a moment to review some important environmental regulations that you should keep in mind.

- Air Quality: New Mexico has specific regulations aimed at controlling air pollution. If your business involves activities that emit pollutants, you’ll need to obtain permits and adhere to emission limits set by the New Mexico Environment Department.

- Water Use and Discharge: For businesses that use or discharge water, such as manufacturing or agricultural businesses, there are regulations regarding water rights and discharge permits. Ensuring proper treatment and disposal of wastewater is crucial.

- Waste Management: Proper disposal of waste is essential. You’ll need to comply with state regulations regarding hazardous waste management and recycling programs to minimize environmental impact.

- Environmental Impact Assessments: Some businesses may need to conduct environmental impact assessments before starting new projects or expansions to evaluate potential effects on the environment.

I recall the challenges I faced when starting my venture, dealing with environmental regulations was quite daunting. However embracing sustainability not only ensured legal compliance but also attracted customers who care about the planet. It took some time to adjust but witnessing the benefits for both the environment and my business was truly fulfilling.

Legal Considerations for Business Owners

Launching and managing a venture goes beyond the routine tasks; it entails navigating various legal factors. These legal nuances play a role in safeguarding your enterprise and securing its lasting success. In New Mexico grasping these aspects can assist you in steering clear of challenges and establishing a solid groundwork for your business.

Here are some important legal factors that entrepreneurs should keep in mind.

- Business Structure: The structure you choose—whether a sole proprietorship, partnership, LLC, or corporation—affects your liability, taxes, and legal obligations. It’s vital to choose the right structure based on your business needs and goals.

- Contracts and Agreements: Drafting clear and comprehensive contracts for agreements with clients, suppliers, and partners is crucial. These documents protect your interests and clarify expectations, reducing the risk of disputes.

- Intellectual Property: Protecting your brand and ideas through trademarks, copyrights, or patents is important. It helps safeguard your innovations and prevent others from using them without permission.

- Compliance with Local Laws: Be aware of any local ordinances or regulations that may impact your business, such as zoning laws or specific business operation permits.

Reflecting on my path I realized how crucial it was to stay updated on the requirements and seek advice from a professional when needed. While it might appear to be an extra cost it’s truly a valuable investment that can prevent you from facing expensive legal troubles in the future. Recognizing and tackling these matters from the outset can greatly impact the prosperity and stability of your venture.

Frequently Asked Questions

Like any topic, people often have inquiries. Here are a few frequently asked questions regarding business regulations in New Mexico along with their responses

- Do I need a business license in New Mexico? Yes, most businesses require a general business license from the city or county where they operate. Additional licenses may be needed depending on your industry.

- What is the gross receipts tax? The gross receipts tax is a tax on the revenue of your business. It applies to the gross amount of money you receive from your business activities, not just profits.

- How often do I need to file tax returns? The frequency of tax return filing can vary. Most businesses need to file quarterly for gross receipts tax and income tax, but specific requirements can depend on your business structure and size.

- What are the penalties for non-compliance with environmental regulations? Penalties can range from fines to more severe legal consequences, depending on the nature and severity of the violation. It’s important to stay compliant to avoid these issues.

- How can I protect my intellectual property? Registering trademarks, copyrights, and patents can protect your intellectual property. Consulting with an intellectual property attorney can help you navigate this process effectively.

This section answers frequently asked questions that both new and seasoned entrepreneurs may have. Its important to stay updated and seek guidance when necessary to navigate these matters efficiently leading to a smoother and more prosperous business journey.

Conclusion

Starting and running a business in New Mexico can be a rewarding but challenging journey. It involves navigating the complexities of regulations and managing your tax obligations all of which require careful attention and planning. Through my own experiences I’ve come to realize that embracing these regulations not helps you stay compliant but also establishes a strong foundation, for long term success. The insights I’ve gained ranging from the significance of contracts to the importance of environmental responsibility have played a role in shaping a successful venture. As you navigate this path keep in mind that staying informed seeking professional guidance when needed and adopting a proactive mindset will serve you well. Your dedication to these principles will pave the way, for a thriving and sustainable business in the enchanting Land of Enchantment.