North Dakota Business Law: What You Need to Know

North Dakota’s business law comprehension is pivotal for anybody attempting to establish or manage a company in this region. The provincial government lays down its distinct principles that navigate the whole cycle from registration to daily functioning. On my first journey through North Dakota’s commercial environment, I was abnormal by the manner in which these laws safeguard enterprises while promoting justice and competition. Therefore, whether one has been involved in entrepreneurship for a long time or just starting out, knowing such rules may mean the whole difference when it comes to achieving success.

Key Regulations Affecting Businesses in North Dakota

The state of North Dakota has numerous fundamental regulations which every proprietor ought to be cognizant of:

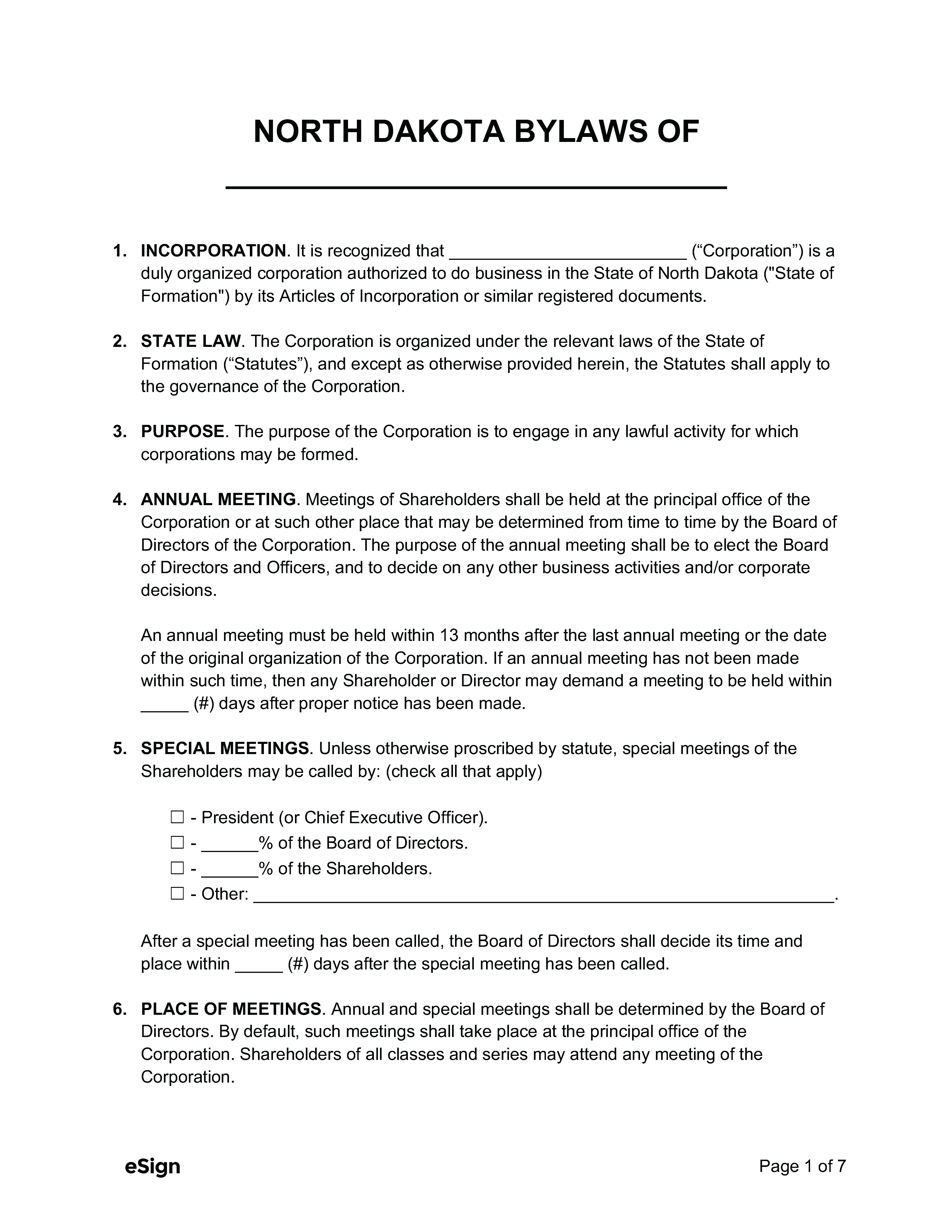

- Corporate Governance: Businesses must adhere to specific governance rules, including holding annual meetings and maintaining accurate records.

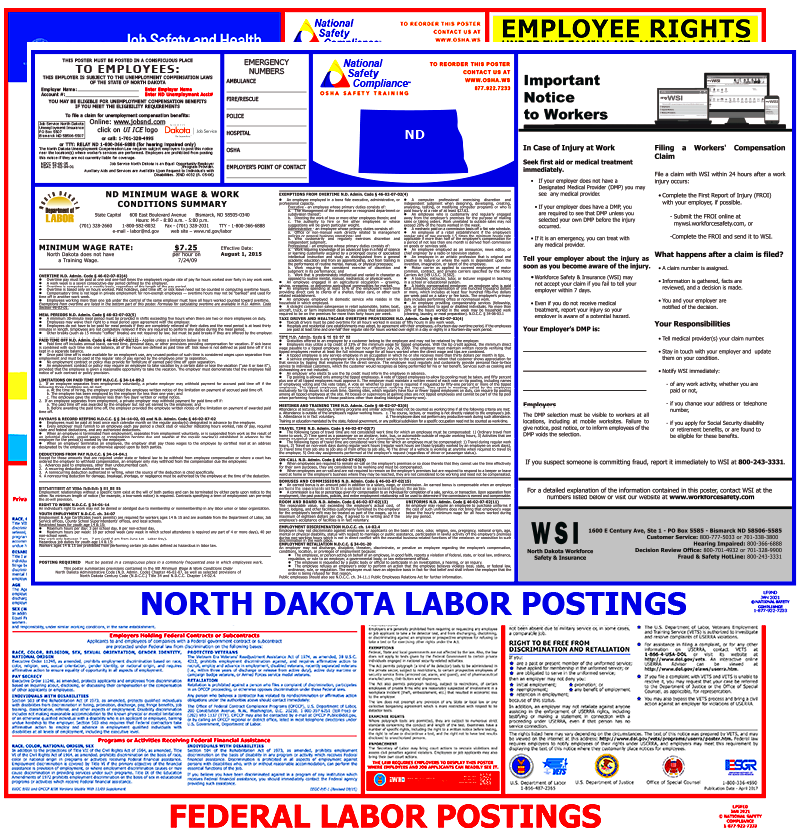

- Employment Laws: These laws cover wages, workplace safety, and employee rights, ensuring a fair workplace.

- Consumer Protection: Regulations protect consumers from unfair business practices, ensuring transparency in advertising and sales.

- Environmental Regulations: Businesses must comply with laws protecting the environment, which can impact operations significantly.

In my journey, learning about these laws permitted me to evade common traps when starting my own company. A good basis in such things may spare one of time and finance at a later stage.

Business Structures and Their Implications

The moment when starting a business, an entrepreneur should choose the right business structure. There are several types of business structures in North Dakota, which have their own pros and cons:

- Sole Proprietorship: This is the simplest form, allowing for full control but also personal liability for debts.

- Partnership: In this setup, two or more people share ownership. It can be easy to establish, but disputes can arise without clear agreements.

- Limited Liability Company (LLC): An LLC offers personal liability protection while allowing for flexible management. This was my choice because it combines simplicity with protection.

- Corporation: This structure provides the most protection from personal liability but comes with complex regulations and paperwork.

Thinking back to my life experiences, I recall that I had to evaluate the advantages and disadvantages of each structure. It is important to take your ultimate recommendations into account and measure their potential risks. Getting in touch with a legal counsel may give you priceless tips that regard to your individual circumstance.

Licensing and Permits Required for Businesses

Embarking upon establishing a company in North Dakota entails steering through the labyrinth of licenses and permits. This can be a daunting task, particularly for novice entrepreneurs. At the beginning of my entrepreneurship journey, I felt daunted by the many licenses I was supposed to have. The specifications are different for each business type and they also change depending on industries or areas.

Here is a rapid view of some of the common permits and licenses:

- Business License: Almost every business needs a general business license to operate legally. This ensures your business is recognized by the state.

- Professional Licenses: Certain professions, like healthcare and law, require specific licenses to practice. It’s crucial to check your field’s requirements.

- Building Permits: If you’re renovating or building a space, local permits are often necessary to ensure safety and compliance with zoning laws.

- Sales Tax Permit: If your business sells goods or services subject to sales tax, you’ll need to register for this permit.

Based on my experience, researching these prerequisites has helped me avoid many potential fines and disturbances. Collaborating with a local lawyer or company advisor can clear things up and help one navigate through the process faster.

Employment Laws and Regulations in North Dakota

For all North Dakota team leaders, it is important to understand employment legislation. These laws seek to ensure that employees and employers are treated equally, thereby creating an equitable workplace. My experience shows that thorough knowledge of these rules engenders trust and contributes to high staff spirits.

Ensure these employment laws are considered:

- Minimum Wage: North Dakota has set a minimum wage that employers must adhere to, which is crucial for fair compensation.

- Workers’ Compensation: This law protects employees who are injured on the job, ensuring they receive medical care and lost wages.

- Anti-Discrimination Laws: Employers must provide a workplace free from discrimination based on race, gender, age, and other factors.

- Overtime Regulations: Understanding how overtime pay works is vital, especially during busy seasons.

I made sure to let my team know their rights during my management career because I felt that was very important to do. This kind of a policy helped us enhance our workplace culture and minimize conflicts.

Tax Obligations for Businesses

It can be tough when it comes to tax obligations in North Dakota when you are running a business. I still have vivid memories from the first fiscal year of my startup, which was both a learning experience and quite stressful! The taxes that apply depend on the structure of your company. Therefore, knowing them well will determine whether you will remain financially fit or not.

One must be conscious of the following tax requirements:

- Sales Tax: If you sell tangible goods, you’ll need to collect sales tax from customers and remit it to the state.

- Corporate Income Tax: Corporations must pay taxes on their profits, which can vary based on income levels.

- Employment Taxes: Employers must withhold taxes from employee wages, including Social Security and Medicare taxes.

- Franchise Tax: Depending on your business structure, you may be liable for a franchise tax based on your business’s net worth or income.

In order to develop my professional skills in filing taxes, I have discovered by doing that keeping detailed records is very important and has to be done throughout the year. In addition, it is suggested that one may engage a tax consultant so as to minimize complications involved in dealing with tax matters.

Common Legal Issues Faced by North Dakota Businesses

It is fulfilling to be an entrepreneur; however, there are legal challenges in businesses as well. Various problems are encountered by entrepreneurs from North Dakota unexpectedly. For instance, I remember when the first legal problem came up, and it was a long-term contract dispute. These are some basic legal problems which one should know about so as to be prepared and perhaps prevent them if possible.

The frequent legal issues that organizations could encounter consist of:

- Contract Disputes: Misunderstandings or disagreements about contract terms can lead to legal battles. Clear, well-drafted contracts are essential to mitigate this risk.

- Employment Issues: From wrongful termination claims to workplace discrimination, employment-related lawsuits can be costly and damaging to a business’s reputation.

- Intellectual Property Concerns: Protecting your brand and creations is vital. Failing to register trademarks or copyrights can lead to infringement issues down the line.

- Compliance with Regulations: Whether it’s environmental laws or industry-specific regulations, non-compliance can result in hefty fines and operational setbacks.

Based on my take aways from life, it is better to take action ahead of time such as by talking to a legal professional to avoid such problems. This means seeking counsel in advance is better than addressing problems after they have become big.

Frequently Asked Questions About North Dakota Business Law

When you delve into the realm of North Dakota business law, there may be issues that are pressing for you. Some Frequently Asked Questions about this subject are presented here based on my experiences and discussions with other entrepreneurs which may help to understand what one feels or thinks when he/she comes across some common issues about it.

- What type of business structure should I choose? It depends on your specific needs. An LLC often provides a good balance of liability protection and tax flexibility.

- How do I obtain a business license? You can apply through your local government office. The requirements may vary based on your business type and location.

- What are the tax implications of my chosen structure? Each business structure has different tax obligations. Consulting a tax professional can provide tailored advice.

- How can I protect my business’s intellectual property? Register your trademarks and copyrights with the appropriate authorities to safeguard your brand.

They usually arise in talks, and finding the correct responses early could make your path simpler.

Conclusion on North Dakota Business Law

Despite the fact that North Dakota business law can be quite a challenge sometimes, it is still significant when attempting to establish a prosperous organization. The knowledge regarding licensing and other common legal problems helps one gain control. It dawned on me through my journey that being informed and taking action were the most important factors in overcoming hurdles.

If it is Nashville, Tennessee or anywhere else in the world, do not forget that law is more than just words in a book. This could mean all sorts of things for you depending on what exactly you are looking to achieve through your business. Co-operating and associating yourself with lawyers, obtaining their advice timely enough, as well as remaining abreast about any possible changes can facilitate your easy traversing around it without fear. Cheers to a successful business career in North Dakota!