Overview of Kentucky Business Regulations

Launching a venture in Kentucky presents a mix of prospects and obstacles. The states scenic bluegrass landscapes and bustling urban centers create an atmosphere for business endeavors. Nevertheless grasping the nuances of local regulations is essential for a seamless experience. While navigating Kentuckys legal framework may appear intimidating at the outset equipping yourself with insights can transform these hurdles into stepping stones, towards achievement. This handbook seeks to streamline the intricate terrain of Kentuckys business rules and offer straightforward actionable guidance, for aspiring entrepreneurs.

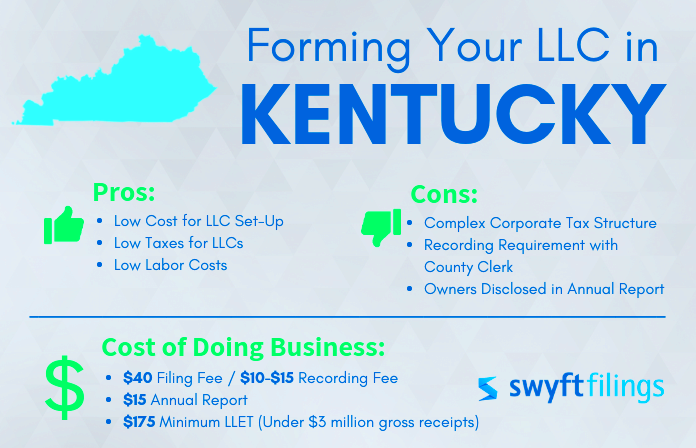

Business Formation Requirements in Kentucky

Starting a business in Kentucky requires following a few key steps to make sure your venture is acknowledged and meets the states legal requirements. Here’s a summary of the important things to keep in mind:

- Choose a Business Structure: Your first step is to decide on the type of business entity—whether it’s a sole proprietorship, partnership, corporation, or limited liability company (LLC). Each structure has its own advantages and implications for liability, taxes, and management.

- Register Your Business Name: If you choose a name other than your personal name or a name that’s not your business structure’s legal name, you need to register it with the Kentucky Secretary of State. This is done through a “Doing Business As” (DBA) registration.

- File Formation Documents: Depending on your chosen structure, you’ll need to file specific documents with the Secretary of State. For instance, LLCs need to file Articles of Organization, while corporations need to file Articles of Incorporation.

- Obtain an Employer Identification Number (EIN): Issued by the IRS, an EIN is crucial for tax purposes and is often required for opening a business bank account.

- Register for State Taxes: Depending on your business activities, you might need to register for various state taxes, including sales tax or income tax withholding.

Looking back on my journey I realized that investing time in grasping these stages really helped things go more smoothly. Its similar to building a solid base for a home it yields benefits down the line.

Licensing and Permits for Kentucky Businesses

Obtaining the licenses and permits is crucial when launching and running a business in Kentucky. This step ensures that you adhere to the laws at the local, state and federal levels. Lets delve into what you may require for this process.

- Business Licenses: Kentucky does not have a general business license. However, depending on your business type and location, you may need specific licenses. For example, a restaurant will need health permits, while a construction business might require contractor licenses.

- Local Permits: Your city or county may have additional requirements. Check with local city or county government offices to determine if you need zoning permits, health permits, or other local approvals.

- State Permits: Certain industries require state-level permits. For instance, businesses dealing with alcohol, firearms, or hazardous materials need special state permits from respective departments.

- Federal Permits: If your business engages in activities regulated by federal agencies—such as agriculture, aviation, or transportation—you may need federal permits. The U.S. Small Business Administration can guide you through these requirements.

From what I’ve seen getting a grasp of these requirements beforehand can help steer clear of obstacles. It’s similar to going through all the essential paperwork before embarking on a journey making sure you don’t overlook any crucial aspects that might impact your travels.

Taxation and Financial Compliance in Kentucky

Taxes, like most

Environmental and Safety Regulations

Running a business in Kentucky goes beyond fulfilling obligations; it also means following environmental and safety standards. These regulations are in place to ensure that companies act responsibly reducing their impact on the environment and prioritizing the well being of their employees. Here’s an overview of the key points to keep in mind.

- Environmental Permits: Depending on your industry, you may need to obtain permits for emissions, waste management, or water discharge. The Kentucky Division of Water and the Environmental and Public Protection Cabinet are key agencies involved in these regulations.

- Waste Management: Proper disposal of industrial waste is not just a legal requirement but also a moral one. Kentucky has stringent rules for hazardous and non-hazardous waste. It’s crucial to set up proper waste management protocols to stay compliant.

- Workplace Safety: The Kentucky Occupational Safety and Health Program (Kentucky OSHA) enforces standards to ensure a safe working environment. This includes regular inspections, safety training, and proper use of personal protective equipment (PPE).

- Emergency Preparedness: Having an emergency plan in place is essential. This plan should include procedures for handling natural disasters, fires, and other emergencies that could affect your business operations.

Based on what I’ve seen addressing these rules from the start can save you a lot of trouble down the road. It’s like baby proofing your house before your little one starts crawling getting things ready in advance makes for an easier journey.

Consumer Protection Laws in Kentucky

In Kentucky protecting consumers is crucial and companies need to follow rules that shield individuals from unfair treatment. Familiarizing yourself with these regulations fosters trust with your clientele and ensures seamless business functioning. Lets explore the key consumer protection laws in Kentucky.

- Fair Trade Practices: The Kentucky Consumer Protection Act prohibits deceptive and unfair trade practices. This means you must be transparent about your products or services and avoid misleading advertisements.

- Product Safety: Products sold in Kentucky must meet safety standards. The state follows federal regulations but also has specific rules for certain products, such as children’s toys and electronics.

- Warranties and Returns: Businesses must honor warranties and return policies as stated. Clear communication about these policies is crucial to avoid disputes and ensure customer satisfaction.

- Credit and Debt Collection: Kentucky has specific rules regarding credit reporting and debt collection. It’s important to comply with these regulations to avoid legal issues and maintain a good reputation.

Based on what I’ve seen respecting consumer rights not only helps you stay within the bounds of the law but also builds a base of loyal customers. It’s similar to showing consideration to your guests at home; a small gesture of kindness can make a difference.

Frequently Asked Questions

Starting and operating a business in Kentucky can bring up a lot of queries. Here’s a compilation of questions to assist in clarifying some typical doubts.

- Do I need a business license in Kentucky? While Kentucky doesn’t have a general business license, specific businesses may need various local, state, or federal licenses and permits.

- How do I choose the right business structure? Consider factors like liability, tax implications, and management style. Consulting with a business advisor or attorney can provide valuable insights tailored to your situation.

- What are the key environmental regulations for my industry? Check with the Kentucky Division of Water and other relevant state agencies to understand specific regulations for your industry.

- How can I ensure compliance with safety regulations? Regular training, safety audits, and adhering to guidelines from Kentucky OSHA can help maintain a safe working environment.

Responding to these inquiries can help shed light on the way ahead similar to using a map during a journey. It enables you to navigate the process with greater assurance and reduced anxiety.

Conclusion

When it comes to navigating the business regulations in Kentucky it can be quite overwhelming, like facing a huge intricate maze. However with some patience and insight it becomes totally doable. The trick is to break down the rules into bite sized chunks similar to assembling a puzzle. Whether it’s grasping how to set up a business or making sure you meet environmental and consumer protection standards each move you make gets you nearer to building a thriving and compliant venture.

Looking back on my journey I found the early obstacles to be quite overwhelming. However every challenge presented an opportunity for growth. Approaching these regulations with a mindset can position your business to not meet legal obligations but also build a reputation for trustworthiness and dependability. So take it slow, ask for guidance when necessary and keep in mind that each regulation you comply with brings you closer to achieving your business objectives. Sending you all the best as you embark on your business venture in Kentucky!