Overview of Pennsylvania Business Law

Pennsylvania business law is crucial for anyone looking to start or run a business in the state. It encompasses various legal rules and regulations that govern business operations, ensuring compliance and protecting business owners. Understanding these laws helps entrepreneurs make informed decisions, avoid legal issues, and operate smoothly. Whether you’re starting a small business or managing a large corporation, knowledge of Pennsylvania’s business law framework is essential.

Types of Business Structures in Pennsylvania

Choosing the right business structure is vital for your Pennsylvania business. Each type has different legal implications, tax responsibilities, and operational flexibility. Here are the primary types of business structures available:

- Sole Proprietorship: The simplest form of business, where one person owns and operates the business.

- Partnership: Involves two or more individuals sharing ownership and responsibilities.

- Limited Liability Company (LLC): Offers liability protection for owners while maintaining flexibility in management.

- Corporation: A more complex structure that separates the business entity from its owners, providing limited liability.

- S Corporation: A special type of corporation that allows profits to pass through to shareholders to avoid double taxation.

Each structure has its own advantages and disadvantages, so it’s important to choose one that aligns with your business goals.

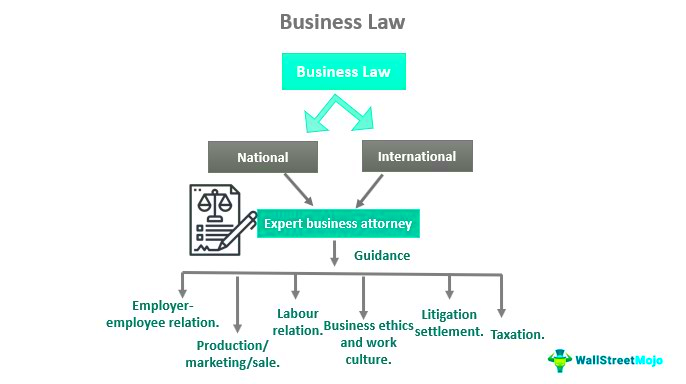

Key Regulations for Businesses in Pennsylvania

Businesses in Pennsylvania must comply with various regulations to operate legally. Understanding these regulations helps prevent legal issues and promotes fair business practices. Here are some key regulations:

- Business Registration: All businesses must register with the Pennsylvania Department of State. This includes filing the necessary documents for your chosen business structure.

- Employer Obligations: Businesses must comply with employment laws, including wage and hour laws, anti-discrimination laws, and workplace safety regulations.

- Consumer Protection Laws: These laws safeguard consumers from unfair business practices, ensuring transparency and fairness in transactions.

- Environmental Regulations: Businesses must adhere to environmental laws to minimize their impact on natural resources.

- Health and Safety Regulations: Compliance with health codes and safety standards is essential, especially for food and healthcare businesses.

Familiarizing yourself with these regulations can help your business thrive and maintain a positive reputation in Pennsylvania.

Business Licenses and Permits in Pennsylvania

Starting a business in Pennsylvania often requires obtaining various licenses and permits. These legal documents ensure that your business operates within the law and meets local, state, and federal regulations. The specific licenses and permits you need depend on your business type, location, and the industry you are in. It’s crucial to research and apply for the necessary licenses to avoid potential legal issues down the line.

Here are some common types of business licenses and permits you might need in Pennsylvania:

- Business License: Most cities require a general business license to operate legally.

- Professional Licenses: Certain professions, such as doctors, lawyers, and real estate agents, need specific licenses to practice.

- Health Permits: Businesses in the food and beverage industry must obtain health permits to ensure compliance with health codes.

- Building Permits: If you’re constructing or renovating a business location, you will need the appropriate building permits.

- Sales Tax License: Required for businesses that sell taxable goods or services.

Always check with local government agencies to ensure you’re applying for the correct permits. Not having the necessary licenses can lead to fines and legal issues, so it’s worth doing your homework!

Employment Laws and Regulations in Pennsylvania

Understanding employment laws and regulations in Pennsylvania is vital for any business owner. These laws protect workers’ rights and outline the responsibilities of employers. Ensuring compliance helps foster a fair and safe work environment. Here are some key employment laws to be aware of:

- Minimum Wage: Pennsylvania’s minimum wage is set higher than the federal minimum wage. Make sure to pay your employees accordingly.

- Overtime Regulations: Employers must pay overtime for hours worked over 40 in a week unless the employee is exempt.

- Anti-Discrimination Laws: Pennsylvania law prohibits discrimination based on race, gender, age, disability, and other factors.

- Workers’ Compensation: Businesses must carry workers’ compensation insurance to cover employees injured on the job.

- Unemployment Compensation: Employers are required to contribute to the unemployment compensation fund for their employees.

Being informed about these laws not only helps you avoid legal troubles but also builds a positive workplace culture that attracts and retains talent.

Taxation for Businesses in Pennsylvania

Taxation is a critical aspect of running a business in Pennsylvania. Understanding your tax obligations can help you manage your finances and avoid penalties. Pennsylvania has several taxes that businesses need to be aware of:

- Corporate Net Income Tax: Corporations must pay a corporate net income tax based on their income earned within the state.

- Sales and Use Tax: Most goods and some services are subject to a 6% sales tax, while certain local jurisdictions may impose additional taxes.

- Employer Withholding Tax: Employers must withhold state income tax from employee wages and remit it to the state.

- Property Tax: Businesses that own property must pay property taxes based on the assessed value of their real estate.

- Business Privilege Tax: Some municipalities charge this tax for the privilege of doing business in their area.

It’s important to keep accurate records and consult with a tax professional to ensure you meet all your tax obligations. Taking proactive steps can save you from unnecessary stre

Dispute Resolution in Pennsylvania Business Law

Disputes are an unfortunate reality in the world of business. Pennsylvania offers various avenues for resolving disputes, helping parties find solutions without lengthy court battles. Understanding these options can save time, money, and stress. Here are some common methods of dispute resolution:

- Negotiation: A direct discussion between parties to reach a mutually acceptable agreement. This method is informal and can be quick.

- Mediation: Involves a neutral third party who facilitates a conversation between the disputing parties. The mediator helps clarify issues and explore solutions but does not impose a decision.

- Arbitration: A more formal process where a neutral arbitrator hears both sides and makes a binding decision. This process is often quicker than going to court.

- Litigation: The traditional court process where a judge or jury decides the outcome. While it can be effective, litigation is often time-consuming and costly.

Choosing the right method depends on the nature of the dispute, the relationship between the parties, and the desired outcome. Many businesses in Pennsylvania find that mediation or arbitration leads to more amicable resolutions, preserving relationships while effectively resolving issues.

FAQ about Pennsylvania Business Law

Have questions about Pennsylvania business law? You’re not alone! Here are some frequently asked questions to help clarify common concerns:

- What licenses do I need to start a business in Pennsylvania? The required licenses depend on your business type and location. Most businesses need a general business license, and certain professions may require additional permits.

- What is the minimum wage in Pennsylvania? As of now, Pennsylvania’s minimum wage is higher than the federal minimum wage. Check for the latest updates as it may change.

- How do I resolve a business dispute? You can resolve disputes through negotiation, mediation, arbitration, or litigation. Choosing the right method depends on your situation.

- What are my obligations as an employer? Employers must comply with labor laws, including paying wages, withholding taxes, and providing a safe working environment.

- Do I need to collect sales tax? Yes, if you sell taxable goods or services, you must collect sales tax from your customers and remit it to the state.

These questions are just the tip of the iceberg. If you have specific concerns, consulting with a legal expert can provide tailored guidance.

Conclusion on Pennsylvania Business Law

Pennsylvania business law is essential for anyone looking to establish or operate a business in the state. Understanding the various aspects of this legal framework, from business structures to licenses, employment laws, taxation, and dispute resolution, can help you navigate the complexities of running a business. By being informed and compliant, you can protect your interests and foster a successful business environment.

Whether you’re a new entrepreneur or a seasoned business owner, staying updated on Pennsylvania’s laws and regulations will keep you prepared for any challenges that may arise. Always consider seeking legal advice to ensure that your business remains compliant and that you’re making the best decisions for your future.