Repo Laws in Tennessee and Your Legal Rights

Repo laws in Tennessee are essential for both lenders and borrowers to understand. These laws outline the rules and procedures surrounding the repossession of property when a borrower defaults on a loan. Knowing your rights can help you navigate this challenging situation and protect your interests. In this post, we’ll explore the repo process, legal requirements, and your rights as a debtor in Tennessee.

Understanding the Repo Process

The repossession process typically begins when a borrower misses payments on a secured loan, such as an auto loan or a mortgage. Here’s how it generally unfolds:

- Missed Payments: If a borrower fails to make payments, the lender may consider the loan in default.

- Contact from Lender: The lender often tries to contact the borrower to discuss the missed payments and find a solution.

- Repossession Notice: If no resolution is reached, the lender may send a formal notice indicating their intent to repossess the property.

- Repossession: If the borrower does not respond, the lender can send a repossession agent to take back the property.

Throughout this process, communication is key. Borrowers should keep in touch with their lenders to explore possible alternatives to repossession, like loan modifications or payment plans.

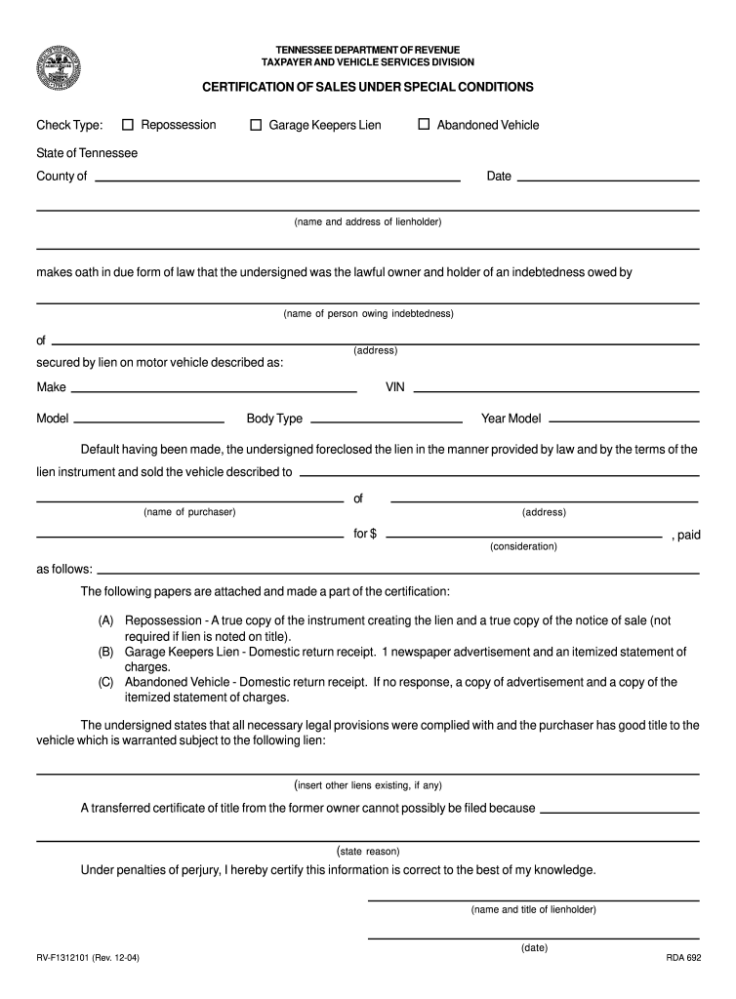

Legal Requirements for Repossession in Tennessee

In Tennessee, there are specific legal requirements that lenders must follow when repossessing property:

- Default on Loan: The borrower must be in default for the lender to initiate repossession. This typically means failing to make payments as agreed.

- Notice of Default: While not always required, many lenders will send a notice of default to the borrower before proceeding with repossession.

- Peaceful Repossession: Repossession must be conducted without breaching the peace. This means that agents cannot use force or threats during the process.

- Right to Cure: Borrowers may have the right to pay the overdue amount and reclaim their property before it is sold.

By understanding these requirements, borrowers can better protect themselves against unlawful repossession actions.

Notice Requirements Before Repossession

Before a lender can repossess your property in Tennessee, they often need to provide you with notice. This is an important step in the repossession process that aims to keep borrowers informed. While Tennessee law does not always require formal notice, many lenders will still send a notice of default to the borrower. Here’s what you need to know:

- Formal Notice: A formal notice of default typically informs you of missed payments and gives you a chance to address the issue before repossession occurs.

- Timing: The lender usually sends this notice as soon as you default. It may outline how much you owe and the timeframe you have to make a payment.

- Communication: Lenders may try to contact you through phone calls, emails, or letters, seeking to resolve the situation before repossessing your property.

- Documentation: Keep copies of all communications from your lender. This documentation can be crucial if you need to dispute the repossession later.

Understanding these notice requirements can help you stay informed and take necessary action to avoid losing your property.

Your Rights During Repossession

When it comes to repossession, knowing your rights is essential. Tennessee law protects borrowers during the repossession process. Here’s what you should keep in mind:

- Peaceful Repossession: Repossession agents must not breach the peace. They cannot use force, threats, or intimidation to take your property.

- Right to Personal Property: If your vehicle or other property is repossessed, you still have the right to retrieve personal belongings inside, such as clothes or tools.

- Notice of Sale: After repossession, the lender must provide notice if they plan to sell your property, giving you a chance to recover any remaining equity.

- Legal Representation: You have the right to seek legal help if you believe your rights have been violated during the repossession process.

Being aware of these rights can empower you to respond appropriately and protect your interests during a difficult time.

What to Do if Your Property is Repossessed

Having your property repossessed can be overwhelming, but there are steps you can take to address the situation. Here’s what to do if you find yourself in this unfortunate circumstance:

- Stay Calm: It’s natural to feel stressed, but try to stay calm and assess your situation logically.

- Review Your Documents: Check your loan agreement and any communication from your lender to understand the specifics of your case.

- Contact Your Lender: Reach out to your lender as soon as possible. Discuss your situation and see if there’s an option to retrieve your property or negotiate a payment plan.

- Understand the Process: Familiarize yourself with the repossession process and your rights, as discussed earlier, to ensure you’re informed about your options.

- Consider Legal Advice: If you believe your rights were violated or you need help navigating your options, consulting a lawyer can provide you with guidance.

- Explore Alternatives: Depending on your financial situation, consider exploring other options, like negotiating a new loan or selling other assets to cover your debts.

By taking these steps, you can better navigate the aftermath of repossession and work toward a resolution.

Possible Defenses Against Repossession

Facing repossession can be daunting, but there are potential defenses you can consider to protect your rights. Understanding these defenses can give you a fighting chance if you’re in this situation. Here are some common defenses against repossession:

- Improper Notification: If the lender failed to notify you properly before repossession, this could be a strong defense. Check if they followed the required notice procedures.

- Payment Arrangements: If you made a payment arrangement with the lender and upheld your end of the deal, repossession may not be justified.

- Unlawful Breach of Peace: If repossession agents used force or intimidation during the repossession process, you may have grounds to challenge the repossession.

- Errors in Loan Agreement: Mistakes in the loan agreement, such as incorrect terms or amounts, could be a valid defense.

- Military Service: If you are in military service, the Servicemembers Civil Relief Act may offer protections against repossession.

Each case is unique, so it’s essential to consult with a legal expert who can provide personalized advice based on your situation. Knowing your defenses can help you navigate this challenging time.

Steps to Take After Repossession

After your property has been repossessed, it’s crucial to act quickly. Here’s a list of steps to help you regain control of the situation:

- Stay Informed: Understand the repossession process and your rights as a borrower to make informed decisions moving forward.

- Contact the Lender: Reach out to your lender to discuss the repossession. They may offer options to reclaim your property or discuss next steps.

- Review Your Finances: Take a close look at your financial situation. This can help you understand whether you can afford to retrieve the repossessed property or negotiate new payment terms.

- Consider Legal Advice: If you believe the repossession was unlawful or you’re unsure of your rights, consulting a lawyer can provide valuable insights.

- Explore Alternatives: Consider alternatives, such as selling other assets or working out a repayment plan with the lender.

- Document Everything: Keep records of all communications and documents related to the repossession, as this may be helpful in any disputes or negotiations.

Taking these proactive steps can help you regain control of your financial situation after repossession.

Frequently Asked Questions

Having questions after a repossession is completely normal. Here are some frequently asked questions to help clarify common concerns:

- What happens to my belongings during repossession?

You have the right to retrieve personal items from the repossessed property. Contact the lender to discuss how to get your belongings back. - Can I stop a repossession?

Yes, you may be able to stop a repossession by making a payment, negotiating with your lender, or by claiming a legal defense. - What if my vehicle is sold after repossession?

If your vehicle is sold, the lender must notify you. You may be entitled to any remaining funds after the sale. - Can I take legal action against the lender?

If you believe the repossession was unlawful or your rights were violated, you may have grounds to take legal action against the lender. - How can I rebuild my credit after repossession?

Rebuilding your credit involves making on-time payments, reducing debt, and monitoring your credit report for inaccuracies.

Understanding these FAQs can help ease your concerns and provide you with the knowledge you need to move forward after repossession.

Conclusion

Navigating repossession laws in Tennessee can be challenging, but understanding your rights and options can empower you during this difficult time. Whether you’re facing repossession or have already experienced it, knowing the process, potential defenses, and steps to take afterward is essential. Always remember that communication with your lender is vital, and seeking legal advice can provide valuable support. By being informed and proactive, you can work towards a resolution that protects your interests and helps you move forward financially.