Residency Laws in Nevada: A Legal Overview

Residency is a crucial aspect of life in Nevada, impacting various rights and responsibilities. In simple terms, being a resident means you live in the state with the intention of making it your permanent home. This status affects everything from voting to taxes. Let’s explore what residency means in Nevada and why it’s essential for individuals and families.

Requirements for Establishing Residency

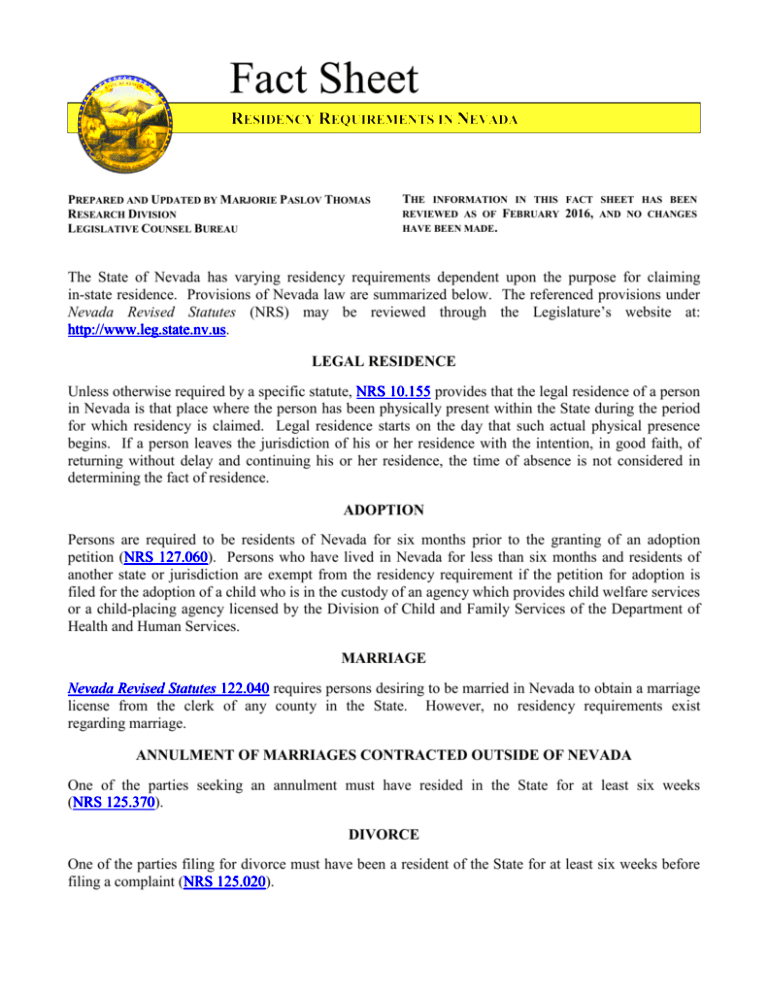

To establish residency in Nevada, certain criteria must be met. Here’s a breakdown of the requirements:

- Physical Presence: You must live in Nevada for at least 183 days within a year.

- Intent to Stay: You should demonstrate a desire to make Nevada your permanent home. This can be shown through various actions, such as securing employment or enrolling children in local schools.

- Registered Address: You need a physical address in Nevada. This can be a rented apartment, house, or any dwelling that you occupy.

- Obtaining a Nevada Driver’s License: If you plan to stay long-term, getting a Nevada driver’s license or ID card is a significant step.

- Registering to Vote: Once you meet the residency requirements, registering to vote in Nevada solidifies your resident status.

Meeting these criteria is vital, especially if you intend to benefit from Nevada’s favorable tax laws.

Types of Residency Status in Nevada

Nevada recognizes different types of residency statuses. Understanding these can help clarify your rights and obligations:

- Full Resident: This applies to individuals who meet all residency requirements and intend to live in Nevada permanently.

- Temporary Resident: Individuals living in Nevada for a limited time, such as students or seasonal workers, fall under this category. They may not have the same rights as full residents.

- Non-resident: Non-residents are those who do not meet the residency requirements. They may still have legal obligations, like taxes on income earned in Nevada.

It’s important to know your residency status as it influences taxation, eligibility for state benefits, and more.

Residency Laws for Students

For students in Nevada, understanding residency laws is vital, especially when it comes to tuition rates and legal obligations. Whether you are attending a college or university, your residency status can significantly impact your education experience, including tuition fees, financial aid eligibility, and housing options. Let’s dive into how residency laws specifically apply to students.

In Nevada, residency laws for students generally consider the following factors:

- Duration of Stay: Students must live in Nevada for a specific period to qualify as residents. Typically, this is at least 12 months before applying for resident tuition rates.

- Intent to Stay: You need to show your intention to make Nevada your permanent home. This could mean securing employment in the state or participating in community activities.

- Financial Independence: Students who are financially independent from their parents may have an easier time establishing residency.

- Documentation: Providing proof of residency, such as rental agreements or utility bills in your name, is often required.

In summary, if you’re a student in Nevada, understanding these laws will help you navigate the educational landscape and maximize your benefits.

Impact of Residency on Taxes

Residency status plays a critical role in determining your tax obligations in Nevada. While Nevada is known for having no state income tax, your residency can influence other tax areas. Let’s break down how residency affects taxes.

Here’s what you need to know:

- No State Income Tax: Nevada does not impose a state income tax, which is a significant advantage for residents.

- Property Tax: Residents are subject to property taxes if they own real estate. The rates can vary based on location.

- Sales Tax: Residents pay sales tax on goods and services, which can vary by county. Understanding your local rate can help you budget.

- Tax Credits and Deductions: Some credits and deductions may be available only to residents. Make sure to check eligibility based on your residency status.

Being aware of these tax implications can help you plan financially and ensure compliance with state regulations.

Residency and Voting Rights

Residency is crucial when it comes to exercising your voting rights in Nevada. Understanding how residency impacts your ability to vote is essential for participating in the democratic process. Let’s explore this further.

Here are the key points regarding residency and voting rights:

- Eligibility to Vote: To register to vote in Nevada, you must be a resident of the state. This means you must meet the residency requirements we discussed earlier.

- Voter Registration: Residents can register online, by mail, or in person. Make sure to provide proof of residency, such as a utility bill or lease agreement.

- Voting Locations: Your residency determines your designated voting precinct. Check your registration to find out where to vote.

- Absentee Voting: If you’re a resident but temporarily away, you can request an absentee ballot to ensure your vote counts.

Understanding the relationship between residency and voting rights empowers you to participate in local and national elections actively.

Legal Consequences of Misrepresentation

Misrepresenting your residency status in Nevada can have serious legal consequences. Whether it’s for tax purposes, education benefits, or voting rights, honesty is crucial. Misrepresentation can lead to fines, loss of benefits, or even legal action. Understanding the risks can help you navigate residency laws effectively and maintain your legal rights.

Here are some potential consequences of misrepresenting your residency:

- Financial Penalties: If caught misrepresenting your residency, you may face hefty fines. This is particularly true for tax-related issues where state authorities can impose severe penalties.

- Loss of Benefits: Individuals who misrepresent their residency to obtain lower tuition rates or financial aid may lose those benefits retroactively, leading to a significant financial burden.

- Criminal Charges: In severe cases, especially when fraud is involved, you could face criminal charges. This can result in a criminal record, which may affect your future opportunities.

- Ineligibility to Vote: Misrepresenting your residency can lead to disqualification from voting, impacting your ability to participate in the democratic process.

Being transparent about your residency status is crucial. Not only does it protect you legally, but it also upholds the integrity of Nevada’s systems.

Frequently Asked Questions

Many people have questions about residency laws in Nevada. Here are some of the most frequently asked questions to help clarify common concerns.

- How do I establish residency in Nevada? To establish residency, you must live in Nevada for at least 183 days a year and show your intent to make it your permanent home.

- What documents do I need to prove residency? Common documents include a Nevada driver’s license, utility bills, lease agreements, and bank statements showing a Nevada address.

- Can I change my residency status? Yes, you can change your residency status by moving out of state and meeting the new state’s residency requirements.

- What are the consequences of being classified as a non-resident? Non-residents may face higher tuition rates and different tax obligations. It’s essential to understand your status.

Conclusion

Understanding residency laws in Nevada is essential for protecting your rights and ensuring compliance with legal obligations. Whether you’re a student, a new resident, or someone navigating tax issues, knowing the requirements and implications of your residency status is crucial. Misrepresentation can lead to significant consequences, so it’s always best to be honest and informed. If you have further questions or need assistance, don’t hesitate to seek legal advice. Staying informed empowers you to make the best decisions in your residency journey.