Tennessee Law for Executors of Estates: Key Points

In Tennessee, the executor is a key figure in overseeing a deceased person’s estate. This person is designated either through the will or if no will exists by judicial order. The executors make sure that the desires of the deceased are respected and that the estate is liquidated methodically. It’s a trustful post that has vast responsibilities as well as legal responsibilities.

The deceased individual’s objectives and the legal procedure are connected by executors. Their duties include collecting assets, settling debts, and allocation of the remaining estate to heirs. Grasping this function is the initial phase in effectively directing estate management.

Requirements for Becoming an Executor

There are specific conditions that must be met while becoming an executor in Tennessee. The following are the most important conditions:

- Age: You must be at least 18 years old.

- Residency: Executors must be residents of Tennessee, although out-of-state executors can be appointed under certain conditions.

- Competency: You should be mentally competent to handle financial and legal matters.

Furthermore, being knowledgeable about the finances of the estate is fundamental and being ready to take on the responsibilities involved is as well. This is because if you are named an executor in a will by the deceased, it makes things easier; however it should still be approved by court.

Duties and Responsibilities of Executors

In Tennessee, there are many responsibilities an executor has to carry out and they are essential. The key duties include:

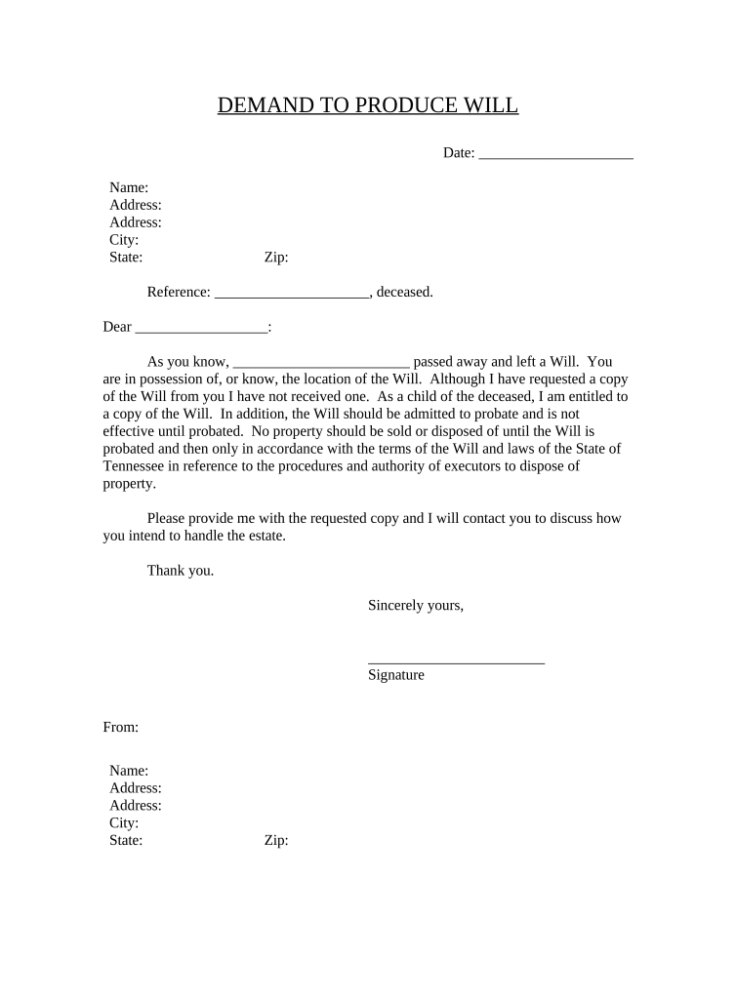

- File the Will: If a will exists, the executor must file it with the probate court.

- Notify Beneficiaries: Inform all beneficiaries about their rights and entitlements under the will.

- Inventory Assets: Compile a detailed list of the deceased’s assets, including property, bank accounts, and personal belongings.

- Manage Estate Assets: Safeguard and maintain the estate’s assets until they are distributed.

- Pay Debts and Taxes: Settle any debts owed by the estate and file necessary tax returns.

- Distribute Remaining Assets: Once debts and taxes are settled, distribute the remaining assets according to the will.

Executing may be a painstaking task which also engages oneself emotionally; however, it serves as an important chance for us to respect those who aced away. Executors must remain systematic and keep proper documents so that there may not arise any disagreements or lawsuits in future.

How to Navigate the Probate Process

Although navigating the probate process in Tennessee may appear difficult, having knowledge of various steps can help you handle it effectively. A deceased person’s estate is settled through probate, which is a legal procedure. It comprises validating the will (if any) and paying off debts before giving out properties to heirs.

Brief and Simple Overview of the Process of Probate:

- Initiate Probate: File the will and a petition for probate with the local probate court.

- Appointment of Executor: The court officially appoints the executor named in the will or, if there’s no will, another qualified individual.

- Notify Interested Parties: Notify beneficiaries and creditors about the probate proceedings.

- Inventory Estate Assets: Prepare a detailed inventory of all assets, which may require appraisals.

- Pay Debts and Taxes: Settle any outstanding debts and taxes owed by the estate.

- Distribute Assets: Once debts are settled, distribute the remaining assets to beneficiaries according to the will.

Probate process, yes, it can take even over one year or several months but being organized and proactive is essential for a smooth run. Thus executors might need to consult an attorney just in case things turn complicated.

Managing Estate Assets Effectively

Managing estate assets is one of the most important things to do as an executor. After being appointed you will mainly focus on safeguarding and increasing their value before they can be passed on to the heirs. The following are some management tactics that work well:

- Conduct Regular Inspections: Regularly inspect properties and assets to ensure they’re in good condition.

- Maintain Records: Keep detailed records of all income and expenses related to the estate.

- Insurance Coverage: Ensure that all assets, especially properties, have appropriate insurance coverage.

- Investment Decisions: Consider consulting a financial advisor for managing investments wisely.

As an executor you should know that you act in the best interests of the estate and its beneficiaries. Effective communication with beneficiaries can also help to prevent conflicts and keep everyone on the same page about asset management.

Remember, as an executor you have to act in the best interests of the estate and its beneficiaries. Beneficiaries can prevent conflicts or misunderstandings if they are open about how their assets should be managed.

Dealing with Debts and Claims Against the Estate

One of the hardest parts of being an executor is handling debts and claims against the estate. When you are settling the estate, make sure you handle any outstanding debts or claims against it properly. This is how to go about this vital part:

- Identify Debts: Compile a comprehensive list of all debts owed by the deceased, including credit cards, mortgages, and personal loans.

- Notify Creditors: Notify creditors of the death and inform them of the probate proceedings.

- Evaluate Claims: Assess any claims made against the estate to determine their validity.

- Pay Valid Debts: Use estate assets to pay off valid debts before distributing any remaining assets to beneficiaries.

The next thing that must be taken with all due caution is the fact that if there are unpaid debts, the executor may have a problem with the law; make sure you record everything well and you should consider getting help from a lawyer in case of quarrels over claims. This requires much care not only for estate protection but also for performance of your responsibilities as an executor.

Executor’s Rights and Compensation

In Tennessee, acting as an executor involves both duties and rights as well as remuneration. It is essential to have knowledge of the same to enable you to perform your job in a way that is effective and also make sure that you are not getting underpaid. Generally, executors receive a fee for their services which can either be set by courts or decided upon by heirs.

Below are some important points about the rights and compensation of executors:

- Right to Information: Executors have the right to access all necessary information regarding the deceased’s assets, debts, and financial accounts.

- Right to Compensation: Executors can receive reasonable compensation for their services, which may vary based on the complexity of the estate. In Tennessee, this is often calculated as a percentage of the estate’s total value.

- Right to Reimbursement: Executors are entitled to be reimbursed for out-of-pocket expenses incurred while administering the estate, such as legal fees or costs associated with asset management.

- Right to Seek Legal Advice: Executors can consult with attorneys and other professionals to ensure they fulfill their duties correctly and comply with state laws.

Yet, actions taken by the executors need to be aimed at doing what is right for the estate and beneficiaries. If they mismanage these resources for their own gain or otherwise, this will result in legal troubles including their possible exclusion from office of executor. Thus an integral aspect is being open and just in all transactions.

Frequently Asked Questions

As an executor, you may have numerous queries about your stature and responsibilities. Below are some burning questions that can help in making sense of common worries:

- What if the deceased didn’t leave a will? If there’s no will, the court will appoint an administrator to handle the estate, following Tennessee’s intestacy laws.

- How long does the probate process take? The probate process can take several months to over a year, depending on the complexity of the estate and any disputes that may arise.

- Can I resign as an executor? Yes, if you find the role overwhelming, you can resign. However, you must file a petition with the court and may need to appoint someone else.

- What happens if there are disputes among beneficiaries? Disputes can be challenging, but as an executor, you should try to mediate. If necessary, legal action may be required to resolve conflicts.

Question that an executor typically has are illustrated here. An attorney can help with further explanations and offer advice on how to proceed in accordance with your dreams.

Conclusion

Such a big responsibility in Tennessee is that of an executor but it’s also a meaningful way of paying tribute to someone you have lost. If you know what you are entitled to, follow through with the probate process and manage the property of the deceased well, there will be a good chance that their desires will come true without any hitches or biases.

When someone is feeling overwhelmed, it’s normal because sometimes this happens; however, one should not hesitate in seeking out legal assistance when such situation arises. This ensures that everything goes smoothly for you yourself and often helps to maintain good relationships with all other beneficiaries. By taking these steps, you’ll be able to ease your worries whilst also safeguarding the estate and fostering cordiality among inheritors. Your efforts can ultimately serve as a way of bringing about closure during trying times and make it less painful for all parties concerned.