Tn Repossession Laws and Your Rights as a Debtor

Tennessee repossession laws are important for both creditors and debtors. Understanding these laws helps you know your rights and responsibilities if you fall behind on payments. Repossession is when a lender takes back property because the borrower has not met the payment terms. This can happen with various types of loans, such as auto loans and personal loans. In this post, we’ll explore how repossession works in Tennessee and what rights you have as a debtor.

Understanding Your Rights as a Debtor

As a debtor in Tennessee, it’s crucial to understand your rights during the repossession process. Here are some key points to remember:

- Notification: Lenders must provide a notice before repossessing your property, although the specific requirements can vary.

- Self-Help Repossession: In Tennessee, lenders can use self-help methods to repossess property, but they cannot breach the peace. This means they cannot use force or threats.

- Right to Redeem: You have the right to redeem your property by paying the total amount owed before it is sold.

- Right to Notice: After repossession, you should receive a notice detailing how to retrieve your property and any auction details if applicable.

Understanding these rights can help you take appropriate actions if faced with repossession. Remember, it’s essential to communicate with your lender and seek legal advice if needed.

Types of Property Subject to Repossession

In Tennessee, various types of property can be subject to repossession. Here’s a quick overview:

| Type of Property | Description |

|---|---|

| Vehicles | Cars, trucks, motorcycles, and boats are common targets for repossession if payments are missed. |

| Furniture | Furniture purchased on credit can also be repossessed if payment terms are not met. |

| Electronics | TVs, computers, and other electronic devices can be taken back if bought through financing. |

| Real Estate | In some cases, real estate can be subject to repossession, but the process is more complex and involves foreclosure. |

Knowing which properties can be repossessed is crucial to help you protect your assets. Always review your loan agreements to understand the risks involved.

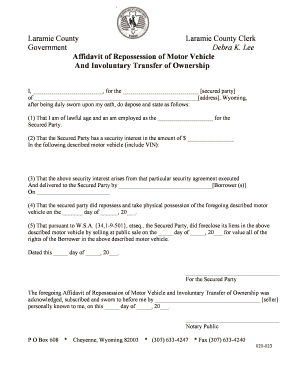

Legal Procedures for Repossession in Tennessee

Understanding the legal procedures for repossession in Tennessee is essential for both creditors and debtors. The process begins when a borrower defaults on a loan, meaning they fail to make payments as agreed. Here’s how the repossession process typically unfolds:

- Default Notification: The lender usually sends a notification about the missed payments, providing an opportunity to rectify the situation.

- Self-Help Repossession: If payments are still not made, the lender can proceed with self-help repossession. This means they can take back the property without court intervention, provided they do not breach the peace.

- Replevin Action: If the lender encounters resistance during repossession, they may file a replevin action in court to legally recover the property.

- Notice of Sale: After repossession, the lender must notify the debtor about the sale of the repossessed property, usually through a written notice.

- Sale of Property: The lender can sell the property at a public auction or through private sale, and the debtor has the right to receive any surplus from the sale after the debt is settled.

Understanding these steps can help you know what to expect if you’re facing repossession. Always consider seeking legal advice to ensure your rights are protected throughout this process.

Steps to Take if Your Property is Repossessed

If your property has been repossessed in Tennessee, it can be a stressful experience. Here are some steps you can take to handle the situation effectively:

- Stay Calm: Take a moment to collect your thoughts. Panicking won’t help the situation.

- Review Your Loan Agreement: Check the terms of your loan to understand why the repossession occurred and your rights regarding the repossession.

- Contact Your Lender: Reach out to your lender to discuss the repossession. Sometimes, they may offer options to retrieve your property or negotiate payment plans.

- Consider Redemption: If you can gather the funds, you may have the right to redeem your property by paying the total amount owed.

- Document Everything: Keep records of all communications with your lender, including dates, times, and what was discussed.

- Seek Legal Advice: If you feel your rights have been violated, consider consulting with a legal professional who specializes in repossession laws.

Taking these steps can help you navigate the aftermath of repossession more effectively and possibly regain your property.

Disputing a Repossession

Disputing a repossession can be a complex process, but it’s important to know that you have options. If you believe the repossession was unjust, here’s how you can approach it:

- Gather Evidence: Collect all relevant documents, such as your loan agreement, payment history, and any correspondence with the lender.

- Identify Grounds for Dispute: Common grounds for disputing a repossession include:

- Improper notification before repossession

- Illegal repossession tactics (e.g., use of force)

- Discrepancies in payment records

- Contact Your Lender: Reach out to your lender to discuss the issue. Sometimes, a simple conversation can resolve misunderstandings.

- File a Complaint: If the lender is unresponsive, consider filing a complaint with the Consumer Financial Protection Bureau (CFPB) or the Tennessee Department of Financial Institutions.

- Seek Legal Action: If all else fails, consult with an attorney about the possibility of pursuing legal action against the lender for wrongful repossession.

Disputing a repossession can be challenging, but knowing your rights and the proper steps can empower you to take action. Don’t hesitate to seek professional help if you feel overwhelmed.

Impact of Repossession on Credit Score

Repossession can have a significant impact on your credit score. When a lender repossesses your property, it signals to credit reporting agencies that you failed to meet your loan obligations. This negative event can lower your credit score, making it harder for you to secure future loans or credit. Here’s how repossession affects your credit:

- Credit Report Notation: A repossession will appear on your credit report, typically for up to seven years. This can deter potential lenders from approving your applications.

- Score Decrease: Depending on your existing credit score, a repossession can decrease your score by 100 points or more, impacting your overall creditworthiness.

- Higher Interest Rates: If you are approved for credit after a repossession, you may face higher interest rates due to the perceived risk by lenders.

- Difficulty Obtaining New Credit: After a repossession, lenders may view you as a higher-risk borrower, which could limit your access to new loans or credit lines.

While repossession is certainly damaging, it’s important to remember that it’s not the end of the world. You can take steps to rebuild your credit over time. Making timely payments on new loans and managing your finances carefully can help improve your score gradually.

Frequently Asked Questions

Understanding repossession laws can be overwhelming, so here are some frequently asked questions to clarify common concerns:

- What is repossession? Repossession is the process by which a lender takes back property when a borrower fails to make payments.

- Can my car be repossessed without warning? Yes, in Tennessee, lenders can repossess vehicles without prior notice, but they must not breach the peace while doing so.

- How long does repossession stay on my credit report? A repossession typically remains on your credit report for up to seven years.

- Can I get my property back after repossession? Yes, you may have the right to redeem your property by paying the total amount owed before it is sold.

- What should I do if I believe my repossession was illegal? You can dispute the repossession with your lender and seek legal advice if necessary.

If you have more questions, don’t hesitate to reach out to a legal professional who specializes in this area.

Conclusion on Tn Repossession Laws

In conclusion, understanding Tennessee repossession laws and your rights as a debtor is essential to navigating the complexities of the repossession process. Knowing how repossession works, what types of property can be repossessed, and your legal rights can empower you to take informed actions if you find yourself facing repossession. Remember, repossession doesn’t have to define your financial future. You can take proactive steps to address the situation, such as communicating with your lender and seeking legal advice.

Ultimately, being aware of the impact on your credit score and knowing how to dispute a repossession can help you regain control. Whether you’re trying to recover your property or rebuild your credit, knowledge is your best ally in dealing with repossession. Don’t hesitate to seek help if you need it; you’re not alone in this journey.