Understanding California Property Tax Laws

Understanding property tax laws in California can seem complicated, but it’s essential for homeowners and potential buyers. These laws determine how much you will pay based on the value of your property. Knowing the ins and outs of these regulations can help you make informed decisions, avoid surprises, and potentially save money. This post will guide you through key aspects of California property tax laws, making the process clearer and more manageable.

Overview of Property Taxes in California

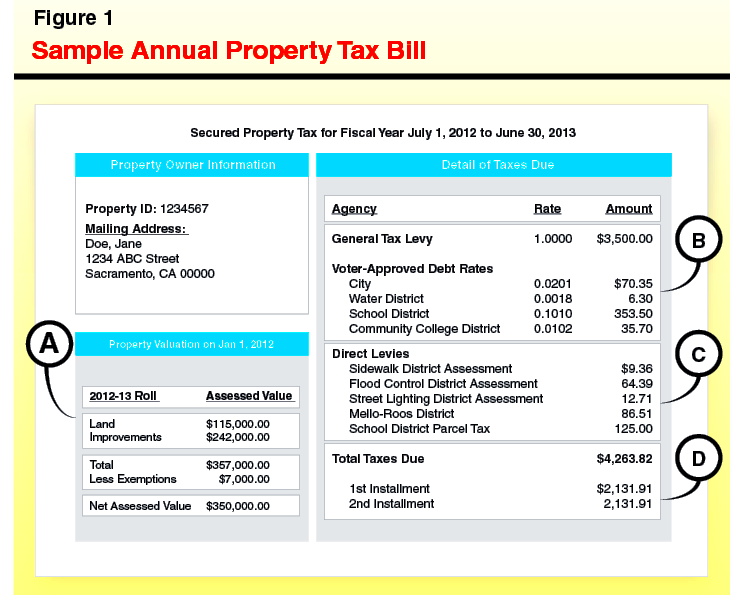

Property taxes in California are primarily based on the value of real estate, including land and buildings. Here’s a quick overview of how these taxes work:

- Ad Valorem Taxes: California employs an ad valorem tax system, meaning taxes are based on the assessed value of the property.

- Tax Rate: The general property tax rate is 1% of the assessed value, plus any additional local rates.

- Fiscal Year: The fiscal year for property taxes runs from July 1 to June 30, with taxes due in two installments.

Each county in California is responsible for collecting property taxes and determining property values. Property taxes are a crucial source of funding for local services such as schools, roads, and emergency services, making it essential for residents to understand how these laws affect them.

How Property Taxes Are Assessed

Assessing property taxes involves determining the market value of a property. Here’s how it typically works:

- Initial Assessment: When you purchase a property, it gets assessed at its purchase price, unless the value exceeds the market value, in which case the market value is used.

- Annual Adjustments: Every year, the assessed value can increase by a maximum of 2%, thanks to Proposition 13. This helps prevent sudden spikes in property taxes.

- Reassessments: If you make significant improvements to your property, or if it changes ownership, it may be reassessed at its current market value.

Property owners receive a notice of their assessed value from their county assessor’s office. If you believe your property has been overvalued, you have the right to appeal the assessment. Understanding this process can help you ensure you’re paying a fair amount in property taxes.

Exemptions and Deductions Available

In California, there are several exemptions and deductions that can help reduce your property tax burden. Understanding these options can save you money and make homeownership more affordable. Here are some of the most common exemptions and deductions:

- Homeowners’ Exemption: If you own and occupy your home as your primary residence, you may qualify for a $7,000 reduction in assessed value, which translates to approximately $70 off your annual property tax bill.

- Senior Citizen Exemption: Seniors aged 62 and older can apply for an exemption that may provide additional savings, particularly if they meet certain income requirements.

- Disabled Veterans’ Exemption: Veterans with a service-related disability may qualify for a full exemption from property taxes or a reduction in assessed value, depending on their disability rating.

- CalVet Home Loan Program: This program offers veterans low-interest home loans and can also provide property tax benefits.

- School Bonds and Local Taxes: Some school bonds may have exemptions based on income or other criteria, so be sure to check your local regulations.

To apply for these exemptions, you’ll need to submit a claim form to your county assessor’s office. It’s a straightforward process, and many homeowners find that they are eligible for at least one type of exemption. Taking advantage of these opportunities can significantly lighten your property tax load.

Understanding Proposition 13 and Its Impact

Proposition 13, passed in 1978, is a landmark law that changed how property taxes are assessed in California. Here’s what you need to know about its impact:

- Property Tax Rate Cap: Proposition 13 limits property tax rates to 1% of the assessed value, plus any voter-approved local taxes.

- Assessment Increases: The assessed value of a property can only increase by a maximum of 2% per year, regardless of market fluctuations. This means that long-term homeowners often enjoy lower tax rates than new buyers.

- Change of Ownership: When a property changes ownership, it gets reassessed at its current market value. This can lead to a significant increase in property taxes for new owners.

While Proposition 13 has provided stability for homeowners, it has also led to disparities in tax bills among property owners. Long-term residents often pay much lower taxes compared to those who buy homes at higher market values. This has sparked ongoing debates about fairness and the need for reform in California’s property tax system.

How to Appeal Property Tax Assessments

If you believe your property has been overvalued and your tax assessment is too high, you have the right to appeal. Here’s how the appeal process works:

- Review Your Assessment: Start by carefully reviewing your property tax assessment notice. Check the assessed value and compare it to similar properties in your area.

- Gather Evidence: Collect data to support your appeal, including recent sales of comparable properties, photos of your home, and any information that demonstrates your property’s lower value.

- File an Appeal: Submit your appeal to your county’s assessment appeals board. Be mindful of deadlines, as they vary by county, typically falling within 60 days of receiving your assessment notice.

- Attend the Hearing: Be prepared to present your case at the hearing. Bring all your evidence, and be ready to answer questions from the board.

Remember, the burden of proof lies with you as the appellant. If your appeal is successful, you could see a reduction in your property taxes. It’s always worth pursuing if you believe you’re being overcharged!

Consequences of Non-Payment of Property Taxes

Failing to pay your property taxes in California can lead to serious consequences. Understanding these repercussions is essential for homeowners. Here’s what can happen if you neglect to pay your property taxes:

- Penalties and Interest: If you miss a payment, penalties and interest will accrue. Initially, there’s a 10% penalty on the unpaid tax amount, and interest begins to accrue at a rate of 1.5% per month.

- Tax Lien: After a period of non-payment, the county may place a tax lien on your property. This lien can affect your credit and make it challenging to sell your home.

- Tax Default: If property taxes remain unpaid for five years, your property may be considered in tax default, and the county can initiate foreclosure proceedings.

- Tax Sale: Ultimately, the county can sell your property at a tax sale to recover the unpaid taxes. This means you could lose your home.

It’s vital to stay on top of your property tax payments and communicate with your county tax office if you’re facing financial difficulties. Many counties offer payment plans or assistance programs to help homeowners manage their tax obligations.

Frequently Asked Questions About California Property Tax Laws

Many homeowners have questions about property tax laws in California. Here are some common inquiries and their answers:

- What is the property tax rate in California? The general property tax rate is 1% of the assessed value, plus any local assessments.

- How often are property taxes reassessed? Properties are typically reassessed when they change ownership or if significant improvements are made. Otherwise, they are limited to a 2% increase per year.

- Can I appeal my property tax assessment? Yes, if you believe your assessment is too high, you can file an appeal with your county’s assessment appeals board.

- What exemptions are available? Common exemptions include the homeowners’ exemption, senior citizen exemption, and disabled veterans’ exemption.

- What happens if I miss a property tax payment? You’ll face penalties, interest, and potential liens on your property. Continuous non-payment can lead to foreclosure.

Understanding these FAQs can help you navigate California’s property tax landscape and avoid common pitfalls.

Conclusion on Understanding California Property Tax Laws

California property tax laws can be complex, but having a grasp of the fundamentals can empower you as a homeowner. From knowing how property taxes are assessed to understanding exemptions and the consequences of non-payment, every bit of knowledge helps you make informed decisions. Remember that Proposition 13 significantly influences how property taxes are calculated and that you have options if you feel your assessment is unfair. Always stay proactive about your tax obligations and take advantage of available resources and exemptions. If you have questions, don’t hesitate to reach out to your local tax office or a professional for guidance. Being informed is the first step toward responsible homeownership.