Understanding Indiana Health Insurance Laws

Hoosiers need to understand health insurance rules for better healthcare choices. Such laws control insurance firms, preventing them from engaging in unfair practices or breaching people’s rights. Since there are several kinds of plans, the knowledge about what is available and how it applies to you is paramount. The various categories of health insurances, some major provider regulations, and consumer rights will be discussed here.

Types of Health Insurance Available in Indiana

In Indiana, folk have different kinds of health insurance plans at their disposal. Below is a breakdown of the most popular choices:

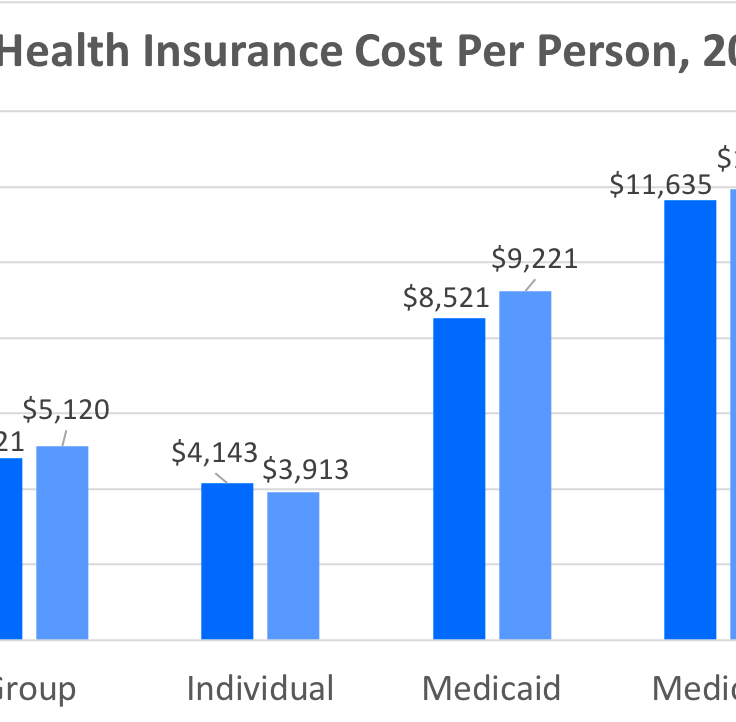

- Individual Health Insurance: These plans are purchased by individuals or families directly from insurance companies. They cover a range of medical services.

- Employer-Sponsored Insurance: Many employers offer health insurance as part of their employee benefits. This often includes group plans that provide lower premiums.

- Medicaid: A state and federal program that offers health coverage for low-income individuals and families. Eligibility is based on income and family size.

- Medicare: A federal program for individuals aged 65 and older, as well as some younger individuals with disabilities. It includes different parts covering hospital care, medical services, and prescription drugs.

- Short-Term Health Insurance: These plans provide temporary coverage and can be useful during transitions between jobs or when waiting for other coverage to begin.

There are many types of insurances with their corresponding advantages and disadvantages hence the need for comparing choices before reaching a conclusion.

Key Regulations for Health Insurance Providers

Indiana has multiple fundamental regulations which control the activities of health insurance providers in order to guard consumers. Among these vital regulations include:

- Coverage Mandates: Indiana law requires certain health benefits to be covered, including mental health services, maternity care, and preventive services.

- Pre-existing Conditions: Insurance companies cannot deny coverage based on pre-existing conditions. This ensures that individuals with health issues can still access necessary care.

- Rate Regulation: The state regulates how much insurers can charge for premiums. This aims to keep insurance affordable for Indiana residents.

- Consumer Protection Laws: These laws require insurers to provide clear information about policy terms, coverage limits, and the appeals process for denied claims.

Understanding these rules ensures the fair treatment by an insurance company and making informed decisions on health insurance.

Consumer Rights Under Indiana Health Insurance Laws

Being an Indiana consumer, it’s important that one should be aware of their rights in relation to health insurance. To make sure that there is equal treatment and enough coverage, the consumers are protected by Indiana law in different ways. Below are some key consumer rights:

- Right to Information: You have the right to receive clear and understandable information about your health insurance policy, including coverage details, exclusions, and the claims process.

- Right to Appeal: If your claim is denied, you have the right to appeal the decision. Insurance companies must provide you with a clear explanation of their denial and a process for appealing.

- Right to Non-Discrimination: Insurance providers cannot discriminate against you based on race, gender, or pre-existing conditions. You should feel secure in your coverage, regardless of your health status.

- Right to Privacy: Your medical records and personal information must be kept confidential. Insurers are required to follow strict privacy regulations to protect your information.

- Right to Choose Providers: Depending on your plan, you may have the right to choose your healthcare providers and specialists without unnecessary restrictions.

You understand the importance of these rights allowing you to stand your ground and guarantee the due medical insurance that belongs to you.

Enrollment Process and Deadlines for Health Insurance

It is important to comprehend how to sign up for health insurance in Indiana so that you can have the necessary coverage. A comprehensive guide of steps is provided below:

- Determine Eligibility: Before enrolling, check if you qualify for Medicaid, Medicare, or other assistance programs based on your income and age.

- Choose a Plan: Research the various health insurance plans available. Consider factors like premium costs, coverage options, and network providers.

- Gather Required Documents: Prepare necessary documents such as proof of income, Social Security number, and identification to make the application process smoother.

- Complete the Application: You can apply online, by phone, or in person. Be honest and thorough in your application to avoid delays.

- Submit the Application: Ensure you submit your application before the enrollment deadline. For most health insurance plans, this occurs during the open enrollment period, which typically runs from November 1 to December 15 each year.

- Receive Confirmation: After submission, you will receive a confirmation regarding your enrollment status. Keep this for your records.

It’s vital because without following these deadlines there will be no continuity in the protection, hence remember it on your planner and make sure you are in touch!

Financial Assistance Programs for Health Insurance

In Indiana, a large number of people and clans might fit into the categories of those who can get cash aid plans to assist them pay for medical cover. The following are some of the potential choices:

- Medicaid: This state and federal program provides free or low-cost health coverage to eligible low-income residents. Eligibility varies based on income, household size, and other factors.

- Premium Tax Credits: If you purchase insurance through the Health Insurance Marketplace, you may qualify for tax credits to reduce your monthly premium costs. This is based on your income and family size.

- Cost-Sharing Reductions: These reduce out-of-pocket costs like deductibles and copayments for eligible individuals enrolled in a Silver-level plan on the Marketplace.

- Hoosier Healthwise: This program provides health coverage for low-income families, pregnant women, and children up to age 19. It offers various benefits, including medical care and preventive services.

- Indiana’s Healthy Indiana Plan: This plan is designed for low-income adults who do not qualify for Medicaid. It focuses on providing health coverage while encouraging personal responsibility through health savings accounts.

Your worries about how to pay for the healthcare you need can be lessened greatly by looking into these financial assistance choices for you and your family members.

Common Issues and Complaints Regarding Health Insurance

Even though there are rules in place, many people residing in Indiana have complaints and problems concerning their health insurance. Knowing this regular challenges is beneficial in overcoming difficulties. These are some usual ones that individuals deal with:

- Claim Denials: One of the most frustrating experiences is having a claim denied. This can happen for various reasons, including lack of coverage for specific services or failure to follow proper procedures. It’s crucial to read your policy carefully and know your rights to appeal.

- High Premiums: Many consumers struggle with rising health insurance premiums, making it difficult to afford coverage. It’s important to shop around and explore different plans to find one that fits your budget.

- Limited Provider Networks: Some health plans restrict which doctors and hospitals you can visit, leading to concerns about receiving adequate care. Always check if your preferred healthcare providers are in-network before enrolling.

- Confusing Policy Terms: Insurance jargon can be complicated and overwhelming. Many people don’t fully understand their policies, leading to unexpected out-of-pocket costs. Don’t hesitate to ask your insurer for clarification on any terms that confuse you.

- Delayed Claims Processing: Sometimes, insurers take a long time to process claims, leaving patients in limbo regarding payment and coverage. Keeping records and following up with your insurer can help expedite this process.

In case any of these problems arise, keep in mind that you possess rights and have access to resources for assistance with your issues.

Frequently Asked Questions about Indiana Health Insurance Laws

There are many inquiries individuals make regarding the health insurance legislation in Indiana. Below are some commonly asked questions that give insight:

- What is the open enrollment period for health insurance? Open enrollment typically runs from November 1 to December 15 each year. During this time, you can enroll in a health plan or make changes to your existing coverage.

- Can I change my health insurance outside the open enrollment period? Yes, if you experience a qualifying life event, such as getting married, having a baby, or losing other coverage, you can apply for a new plan during a special enrollment period.

- How can I file a complaint against my insurance provider? You can file a complaint with the Indiana Department of Insurance if you believe your insurer is not complying with state laws or treating you unfairly. They can investigate and help resolve the issue.

- What should I do if my claim is denied? First, review your policy to understand why the claim was denied. Then, gather any necessary documentation and follow the insurer’s appeals process. You can also contact the Indiana Department of Insurance for assistance.

- Are there resources available for understanding health insurance? Yes, many organizations and websites provide resources to help you understand health insurance options, including the Indiana Department of Insurance and local consumer advocacy groups.

If you are aware of the important elements of health insurance, it is much easier for you to make more appropriate choices regarding your healthcare requirements.

Conclusion on Indiana Health Insurance Laws

Health insurance laws in Indiana can be so overwhelming to handle but if you know what your rights are, what options are available for you and the regulations that are set up for this purpose then this process is quite simple. By understanding types of policies offered on the market and their enrolment rules, as well as consumer rights; you will be able to make right decisions about your health care demands and financial abilities.

Keep in mind that help is available should you run into difficulties. If you need help understanding your policy or locating programs for financial support, you do not have to tackle these problems alone. By being aware and taking initiative, controlling your health insurance plan will become easier for you. You are a treasure; getting the right protection is what keeps you healthy.