Understanding Minnesota’s Home Insurance Claim Laws

When it comes to filing home insurance claims in Minnesota it’s important to be aware of the specific details involved. Dealing with storm damage or an unforeseen event can make the process of navigating your insurance claim quite challenging. I recall the exasperation I felt trying to figure out the steps to take after a powerful storm struck our region. It was overwhelming and I longed for clear direction. This guide aims to make that journey easier for you by keeping you well informed at every stage of the process.

Understanding Minnesota’s Home Insurance Regulations

In Minnesota the rules for home insurance are designed to tackle the specific challenges brought on by our climate and surroundings. These guidelines make sure that homeowners are treated fairly and that insurance providers conduct their business transparently. Lets delve into some important points regarding these regulations.

- State Requirements: Minnesota mandates certain coverage levels for home insurance policies to ensure adequate protection. This includes coverage for damage from natural disasters like tornadoes and floods, which are common in our region.

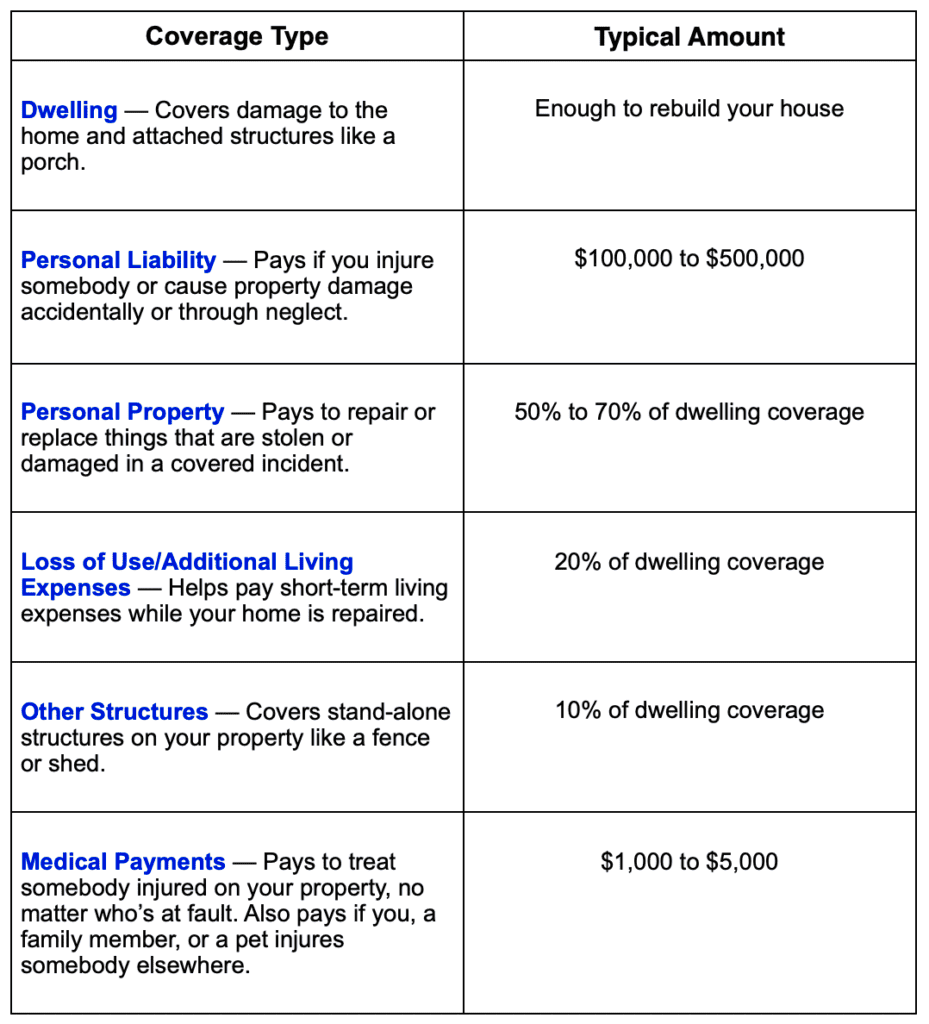

- Coverage Types: Policies generally include dwelling coverage, personal property coverage, liability coverage, and additional living expenses. Each type serves a distinct purpose and provides comprehensive protection.

- Consumer Protections: Minnesota law includes provisions to protect homeowners from unfair practices. Insurance companies must adhere to specific rules regarding claim processing and payment timelines.

Grasping these rules can assist you in making choices regarding your coverage and what to anticipate when filing a claim. Its similar to being aware of the game before you begin playing; it streamlines the process and reduces stress levels.

How to File a Home Insurance Claim

Submitting a home insurance claim in Minnesota might seem overwhelming at first. However by breaking it down into steps you can navigate the process more easily. Drawing from my own experiences heres a simple roadmap to assist you:

- Document the Damage: Start by thoroughly documenting the damage. Take clear photos or videos of the affected areas and any damaged property. This visual evidence is crucial for supporting your claim.

- Contact Your Insurance Company: Notify your insurance provider as soon as possible. Most companies have a dedicated claims department that can guide you through the process. Provide them with the necessary documentation and details of the incident.

- Complete the Claim Form: Fill out the claim form provided by your insurance company. Ensure that all information is accurate and complete to avoid delays. Include copies of your documentation with the form.

- Schedule an Inspection: An insurance adjuster will likely need to inspect the damage. Be prepared for their visit and provide them with all the relevant information about the incident and damage.

- Review the Settlement Offer: Once the inspection is complete, your insurance company will offer a settlement amount. Review this offer carefully. If it seems insufficient, you have the right to negotiate or seek additional advice.

Submitting a claim can be quite a challenge but with some patience and careful attention to detail it can really pay off. I remember feeling swamped by all the paperwork when I filed my claim but keeping things tidy and taking the initiative made a difference in getting a positive outcome. Just keep in mind you’re not in this alone there are resources out there to assist you if you require assistance.

Key Steps in the Claim Process

Submitting a claim for your homeowners insurance can sometimes be a bit of a challenge. Based on my insights being aware of the essential steps involved in the process can boost your confidence in handling it. Here’s a simple strategy to make sure you don’t miss anything.

- Initial Notification: As soon as you notice damage, contact your insurance company to report the incident. Provide them with preliminary details and ask about the next steps. This initial call sets the tone for the rest of the process.

- Gather Documentation: Collect all necessary documents such as photographs of the damage, receipts for repairs, and any relevant correspondence. Having a well-organized file can greatly expedite the claim process.

- Complete the Claim Form: Fill out the claim form provided by your insurer. Ensure that you’re thorough and accurate to prevent any delays. Double-check all information before submission.

- Schedule an Inspection: Your insurance company will likely send an adjuster to inspect the damage. Be sure to be present during the inspection and provide them with any additional information they may need.

- Review the Settlement: Once the adjuster has completed their assessment, review the settlement offer carefully. Make sure it reflects the actual cost of repairs or replacement. If it doesn’t, you have the right to discuss it further with your insurer.

- Complete Repairs: Once you agree on a settlement, you can proceed with repairs. Keep all receipts and documents related to the repair work, as your insurer may require them for final processing.

Following these steps can make it easier for you to go through the claims process. I recall experiencing a blend of relief and anxiety during my own claims journey, but being well organized and knowledgeable really helped me along the way.

Common Reasons for Claim Denials

Dealing with a claim denial can be really exasperating, especially when you’ve followed all the rules. Based on my own experiences and what I’ve learned in the industry here are a few reasons why claims may get rejected.

- Policy Exclusions: Some damages might not be covered under your policy. For example, certain types of natural disasters or wear and tear might be excluded. Always review your policy’s exclusions to understand what’s not covered.

- Insufficient Documentation: If your documentation is lacking or incomplete, your claim could be denied. This is why it’s crucial to keep thorough records and submit all required documents.

- Late Reporting: Most insurance policies require prompt reporting of damages. Delaying notification can lead to a denial. Always report damage as soon as you discover it.

- Unpaid Premiums: If your insurance premiums are not up-to-date, your coverage may be invalid. Ensure that all payments are made on time to avoid complications.

- Policy Lapses: If your policy has lapsed due to non-renewal or cancellation, claims may be denied. Keep track of renewal dates and make necessary payments.

By recognizing these reasons you can steer clear of challenges and be more equipped to handle a denial if it comes your way. I remember an instance when my claim was rejected at first because of inadequate paperwork. However I resolved the matter by providing the required details again and managed to change the outcome. Stay alert and well informed and don’t hesitate to ask your insurance company for clarification, if necessary.

How to Appeal a Denied Claim

If your claim gets rejected dont despair. Fighting against a denial can be a way to achieve the outcome you deserve. Drawing from my experiences and insights, heres a roadmap to assist you in navigating the appeals journey.

- Review the Denial Letter: Carefully read the denial letter to understand the specific reasons for the rejection. This will help you address the issues in your appeal.

- Gather Supporting Documents: Collect any additional evidence that supports your claim. This might include new photos, repair estimates, or updated reports. The more thorough your documentation, the stronger your appeal will be.

- Write a Formal Appeal Letter: Draft a clear and concise appeal letter addressing the reasons for denial. Include all supporting documents and explain why you believe the claim should be reconsidered. Be polite but firm in your request.

- Submit Your Appeal: Send your appeal letter and supporting documents to your insurance company’s claims department. Keep copies of everything you send and track your correspondence.

- Follow Up: After submitting your appeal, follow up with the insurance company to ensure they received it and are processing it. Persistence can be key to a successful appeal.

Challenging a denied claim can be tough but it’s usually worth the effort. I remember when I had to contest a denial; it was a process but being organized and determined made a difference in getting a favorable result. Keep in mind that your insurance company is required to review your appeal impartially, so don’t hesitate to advocate for your rights.

Legal Rights and Protections for Homeowners

As a homeowner in Minnesota it’s essential to understand your legal rights and safeguards when it comes to handling insurance claims. Having gone through this process personally I can vouch for the significance of being aware of what you are entitled to. Here is an overview of the essential rights and protections that can assist you during the claims process.

- Right to Fair Treatment: Minnesota law mandates that insurance companies treat policyholders fairly. This includes processing claims in a timely manner and providing clear reasons for any denial.

- Right to Appeal: If your claim is denied, you have the right to appeal the decision. The insurance company must provide a clear explanation for the denial and allow you to submit additional evidence or documentation.

- Protection Against Unfair Practices: The state has regulations to prevent insurance companies from engaging in unfair practices, such as delaying payments or offering settlements that are significantly less than the actual cost of damages.

- Transparency in Policy Terms: Insurance companies are required to provide clear and understandable information about policy terms and conditions. You should be fully informed about what your policy covers and any exclusions it may have.

- Legal Recourse: If you believe your insurance company is not complying with the law or your policy terms, you have the right to seek legal recourse. This can involve filing a complaint with the Minnesota Department of Commerce or pursuing legal action.

Grasping these rights can have an impact on navigating insurance claims. I recall the sense of comfort I felt upon learning about my rights during a claim. It empowered me to stand up for myself with assurance. Be aware of your rights and leverage them to ensure you are treated justly throughout the journey.

How to Choose the Right Home Insurance Policy

With a wide range of choices out there picking the home insurance policy can be quite a task. Having been in this situation I know how crucial it is to find a policy that suits your requirements. Here are some helpful suggestions to assist you in making the right decision.

- Assess Your Coverage Needs: Start by evaluating what you need coverage for. Consider factors like the value of your home, personal belongings, and potential liabilities. A policy that covers just the basics might not be sufficient if you have valuable assets or live in an area prone to natural disasters.

- Compare Policies: Don’t settle for the first policy you come across. Compare different policies from various insurers to find the one that offers the best balance of coverage and cost. Use online comparison tools or consult with an insurance agent to help with this process.

- Understand the Policy Terms: Read the fine print carefully. Make sure you understand what’s covered and what’s not, including any exclusions or limitations. This can prevent surprises when you file a claim.

- Consider Customer Reviews: Look at reviews from other policyholders to gauge the insurer’s reputation for customer service and claims handling. Personal experiences shared by others can provide valuable insights.

- Evaluate Discounts and Benefits: Check if the insurer offers any discounts for things like bundling policies or having security features in your home. These discounts can help lower your premium while still providing comprehensive coverage.

Selecting the policy that suits you best requires careful thought and consideration. I recall the sense of relief I experienced when I discovered a plan that aligned with my requirements and financial capabilities. Be sure to take your time, pose inquiries and make a choice to ensure your home is adequately safeguarded.

Frequently Asked Questions

When it comes to handling home insurance claims it’s normal to have inquiries. Based on my personal experiences and observations here are a few questions that are often asked that could shed light on concerns.

- What should I do immediately after damage occurs? Document the damage thoroughly with photos or videos and report it to your insurance company as soon as possible. Prompt action can help speed up the claims process.

- How long does it take to process a claim? The time to process a claim can vary depending on the complexity and the insurer’s procedures. Generally, it can take anywhere from a few weeks to a couple of months. Stay in touch with your insurer for updates.

- Can I handle repairs before the adjuster arrives? It’s best to wait for the adjuster’s inspection before making major repairs. However, you should take steps to prevent further damage, such as covering broken windows or shutting off water leaks.

- What if I’m not satisfied with the settlement offer? You have the right to negotiate the settlement offer or appeal if you believe it’s insufficient. Gather supporting evidence and communicate clearly with your insurer to reach a fair resolution.

- How can I prevent claim denials in the future? Keep detailed records of your property and its value, pay attention to policy exclusions, and ensure timely reporting of any issues. Regularly reviewing your policy and keeping it up-to-date can also help avoid future problems.

These frequently asked questions aim to tackle issues that individuals often encounter regarding home insurance claims. I recall grappling with inquiries during my own journey and discovering straightforward responses that streamlined the process significantly. If you have inquiries feel free to reach out to your insurance provider or seek guidance for assistance.

Conclusion

Navigating the process of filing insurance claims in Minnesota can be quite challenging. However having a good grasp of the key points can make a significant impact. From being aware of your rights to choosing the right policy every step is vital for a seamless claims experience. I recall the sense of relief I felt when I finally comprehended the intricacies of my own policy and the claims procedure. It does take some time to get used to but with information and a proactive mindset you can manage it efficiently. Always stay up to date maintain records and don’t hesitate to seek assistance if necessary. With these tools at your disposal you’ll be well equipped to safeguard your home and protect your interests.