Understanding Non-Covered Services Laws by State

Non-covered services are medical services or treatments that are not included in a patient’s health insurance plan. Understanding these services is crucial for patients and providers alike. Knowing what is covered and what isn’t helps avoid unexpected costs and ensures better health management. It’s essential to familiarize yourself with your specific state laws regarding non-covered services, as they can vary significantly across the country.

Importance of Understanding State Laws

Understanding state laws surrounding non-covered services is vital for several reasons:

- Financial Awareness: Patients need to know which services they may have to pay for out of pocket. This knowledge helps in budgeting and planning for medical expenses.

- Provider Compliance: Healthcare providers must comply with state regulations to avoid legal issues. Knowing the laws helps them guide patients effectively.

- Patient Rights: Patients should be aware of their rights regarding non-covered services. This includes understanding their options and potential appeals if a service is denied.

- Insurance Policies: Insurance companies often have different policies regarding non-covered services. Understanding these can lead to better negotiations or appeals when necessary.

Ultimately, being informed empowers both patients and providers, leading to more effective communication and better healthcare outcomes.

Variations in Non-Covered Services by State

Non-covered services can vary widely from state to state due to different regulations and healthcare policies. Here are some factors that contribute to these variations:

- State Legislation: Each state has its own laws governing health insurance, which can affect what services are considered non-covered.

- Insurance Providers: Different insurance companies may interpret state laws in various ways, leading to discrepancies in coverage.

- Service Types: Some states may have specific exclusions for certain types of services, like experimental treatments or cosmetic procedures.

- Patient Populations: Different demographics and health trends in states can also influence the types of services that are commonly excluded.

Here’s a brief comparison of non-covered services in select states:

| State | Common Non-Covered Services |

|---|---|

| California | Cosmetic surgery, certain dental services |

| Texas | Experimental treatments, non-emergency transportation |

| New York | Acupuncture, certain nutritional supplements |

These variations highlight the importance of checking your specific state’s regulations and your insurance policy to avoid surprises.

Common Examples of Non-Covered Services

When it comes to non-covered services, it’s helpful to know what types of treatments or procedures may fall into this category. Here are some common examples:

- Cosmetic Surgery: Procedures that are done for aesthetic reasons, like facelifts or breast augmentation, are often not covered.

- Experimental Treatments: Treatments not widely accepted as standard care, such as certain gene therapies or unproven clinical trials, are usually excluded.

- Alternative Therapies: Services like acupuncture, chiropractic care, or naturopathy may not be covered by many insurance plans.

- Long-Term Care: Many plans do not cover extended care services, such as nursing home stays or assisted living.

- Some Dental Services: While basic dental care may be covered, services like teeth whitening or orthodontics can be considered non-covered.

Knowing these examples can help patients better understand what they might be responsible for financially, allowing them to make informed decisions about their healthcare options.

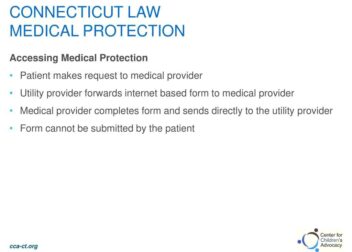

Legal Implications for Providers and Patients

The legal implications of non-covered services can affect both providers and patients. Here’s what to consider:

- Provider Liability: If a provider fails to inform a patient that a service is non-covered, they may be held liable for the cost of that service.

- Patient Responsibility: Patients may be responsible for costs if they receive services without understanding their non-covered status, leading to unexpected bills.

- Disputes and Appeals: If a patient feels a service should be covered, they can often appeal to their insurance provider. Understanding the legal framework for these appeals is crucial.

- State Regulations: Providers must stay informed about state-specific laws that dictate how non-covered services are handled, including any required disclosures to patients.

Understanding these legal implications can help both patients and providers navigate the complexities of healthcare and insurance more effectively.

How to Navigate Non-Covered Services

Navigating non-covered services can seem daunting, but there are steps you can take to make the process smoother:

- Review Your Policy: Start by carefully reading your health insurance policy to identify what is covered and what isn’t. Look for a list of non-covered services.

- Ask Questions: Don’t hesitate to ask your healthcare provider or insurance representative about services that you’re unsure about. Clear communication can prevent misunderstandings.

- Document Everything: Keep records of all communications with your insurance provider. If a service is denied, having documentation can be invaluable for appeals.

- Consider Alternatives: If a service is non-covered, ask your provider if there are alternative treatments or therapies that are included in your plan.

- Utilize Resources: Many state health departments and consumer advocacy groups provide information about non-covered services and rights. Take advantage of these resources.

By taking these proactive steps, you can navigate non-covered services with more confidence, ensuring that you make informed decisions about your healthcare.

Resources for Further Information

When it comes to understanding non-covered services laws, having reliable resources at your disposal is essential. Here are some valuable sources of information:

- State Health Departments: Your local health department often provides guidelines and resources on healthcare laws, including non-covered services. Visit their website for information tailored to your state.

- Insurance Company Websites: Most insurance companies have detailed explanations of their policies, including coverage and exclusions. Reviewing your specific plan’s documents can clarify what is covered.

- Legal Aid Organizations: Organizations that specialize in health law can offer free or low-cost advice regarding your rights and responsibilities concerning non-covered services.

- Consumer Advocacy Groups: Groups like the National Patient Advocate Foundation provide educational materials and support for navigating healthcare complexities.

- Online Forums: Websites such as Reddit or specific health-focused forums can offer peer advice and personal experiences that help illuminate the landscape of non-covered services.

These resources can empower you to make informed choices regarding your healthcare and insurance options, helping you navigate the sometimes tricky waters of non-covered services.

FAQs About Non-Covered Services Laws

It’s common to have questions about non-covered services. Here are some frequently asked questions to help clarify any confusion:

- What are non-covered services? Non-covered services are medical treatments or procedures that your insurance policy does not pay for, meaning you are responsible for the full cost.

- How can I find out if a service is non-covered? Check your insurance policy documentation, or ask your healthcare provider or insurance representative directly.

- Can I appeal a non-covered service denial? Yes, if you believe a service should be covered, you can typically file an appeal with your insurance company.

- Are all states the same in terms of non-covered services? No, non-covered services can vary significantly by state due to different regulations and laws governing healthcare.

- What happens if my provider does not inform me about non-covered services? Providers may be held liable if they fail to disclose this information, leaving patients responsible for unexpected bills.

These FAQs can help you better understand your rights and responsibilities related to non-covered services, making it easier to navigate your healthcare journey.

Conclusion on Non-Covered Services Laws

In conclusion, understanding non-covered services laws is essential for both patients and providers. Being informed about what services are excluded from coverage can help you avoid unexpected costs and ensure better healthcare management. It’s crucial to review your insurance policy carefully, ask questions, and utilize available resources to clarify your rights and responsibilities.

By taking the time to understand non-covered services, you empower yourself to make informed decisions about your health. Remember that resources are available to assist you, from state health departments to consumer advocacy groups. Ultimately, the more you know, the better equipped you will be to navigate the complexities of healthcare and insurance.