What You Need to Know About Massachusetts Mileage Reimbursement Law

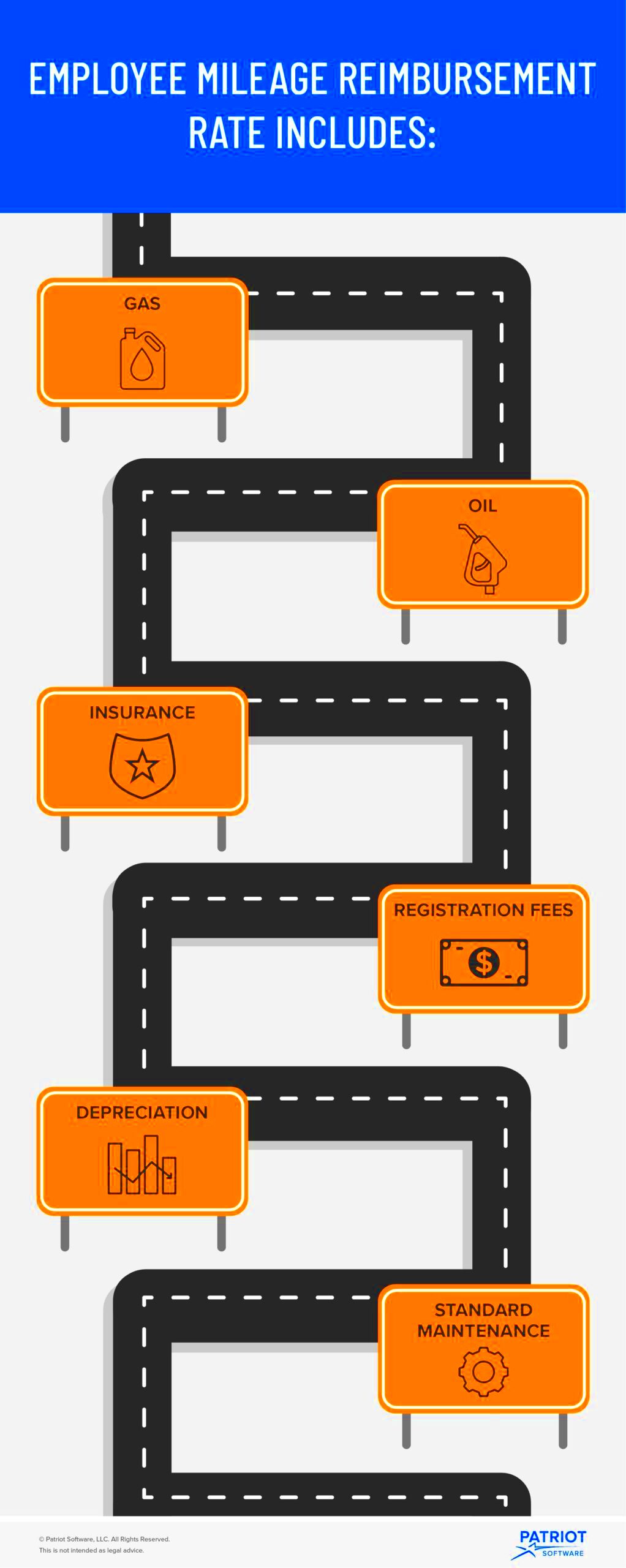

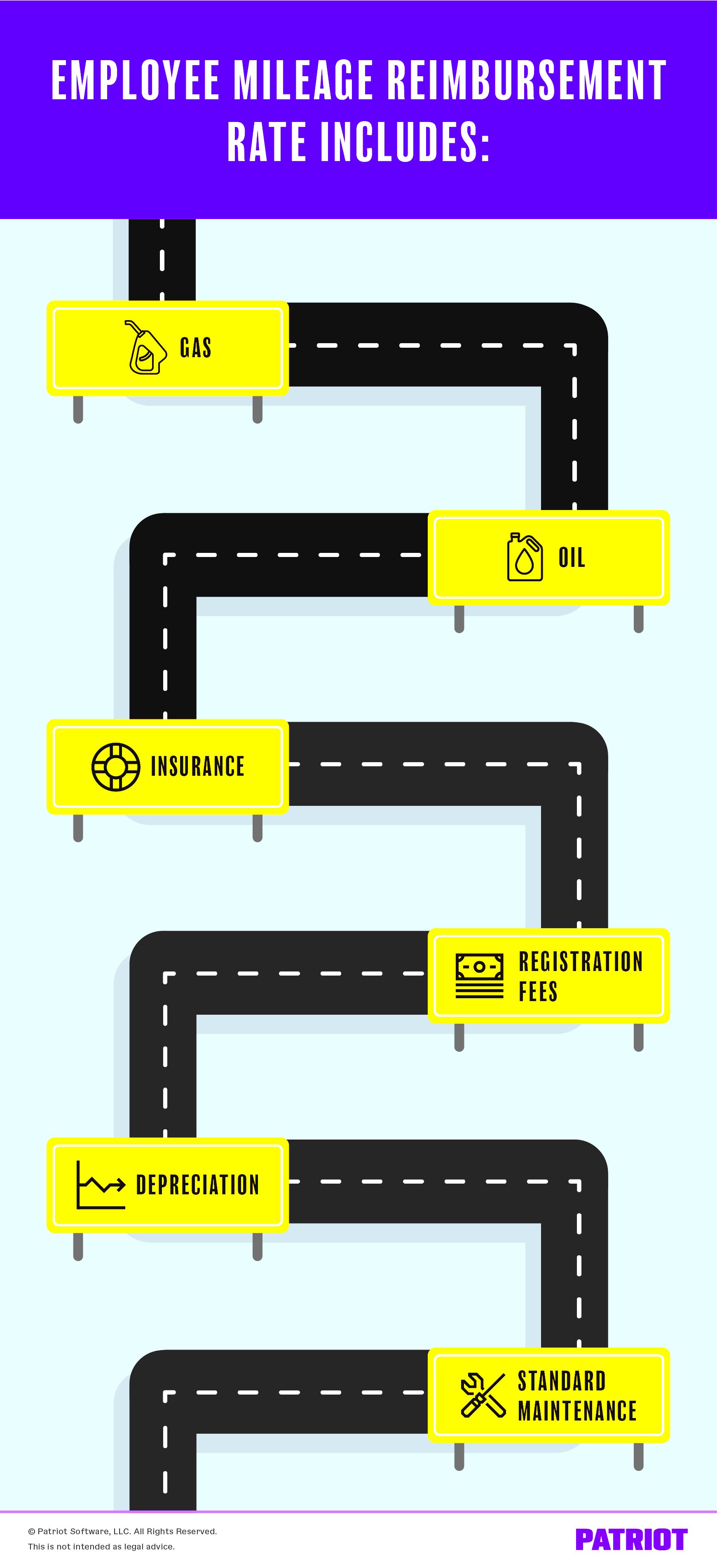

The law on reimbursement of mileage in Massachusetts is paramount for the employees who drive for work. The law provides a guarantee that workers will be compensated for all costs incurred when they use their own vehicles for carrying out official duties. It assists in covering expenses related to gasoline, maintenance and vehicle depreciation. Comprehension of such laws is very important to both employees and employers so that they can achieve just compensation and adhere to state regulations.

Who is Eligible for Mileage Reimbursement

In Massachusetts, there are certain employees who have a possibility to get mileage reimbursement while not all are entitled. The following is a list of the major classes of employees that could be eligible:

- Employees using personal vehicles: If you use your own car for work-related tasks, you may be eligible.

- Independent contractors: Those working as freelancers or independent contractors can also claim mileage if they use their vehicles for business.

- Temporary workers: Even temporary or part-time employees may qualify if their job requires travel.

But the criteria for qualification may differ according to individual companies’ philosophies. Therefore it is important to consult either with your boss or with your HR team for detailed rules about transportation expenses in your job place.

How to Calculate Mileage Reimbursement Rates

For those in Massachusetts, figuring out how to compute mileage reimbursement can seem tricky at first glance but it becomes easy as soon as you understand the steps. That is how to go about it:

- Determine the mileage driven: Keep track of the total miles driven for work. Use a mileage log or a mileage tracking app.

- Know the reimbursement rate: The Massachusetts state rate often aligns with the IRS mileage rate. For 2024, the IRS rate is 65.5 cents per mile. This can change yearly, so stay updated.

- Calculate your reimbursement: Multiply the total miles driven by the reimbursement rate. For example, if you drove 100 miles at the rate of $0.655, your reimbursement would be:

| Total Miles Driven | Reimbursement Rate | Total Reimbursement |

|---|---|---|

| 100 miles | $0.655 | $65.50 |

To support your claims, keep all transactions and proper records. The easier you make the development of your claims, the easier it will be to get back money during a reimbursement process.

Documentation Requirements for Mileage Reimbursement

In Massachusetts, it is vital that you have the right paperwork when filing for mileage reimbursement. Proper and legitimate documentation ensures that you receive your dues as well as protect your legal interests. Making sure that you are well organized may deter future inconveniences related to the same. The following are some of the requirements usually:

- Mileage log: Maintain a detailed log of your trips, including the date, destination, purpose of the trip, and total miles driven. This can be a physical notebook or a digital app.

- Receipts: Collect receipts for any expenses related to your trips, such as tolls or parking fees. These can add up and increase your reimbursement amount.

- Employer policy: Familiarize yourself with your employer’s mileage reimbursement policy. Make sure you understand what they require for documentation.

- Reimbursement request form: Some companies have specific forms you need to fill out. Ensure you complete these accurately and submit them on time.

Reimbursement process can be made smoother by proper documentation. Therefore, if you want to receive everything that is owed to you then ensure proper documentation is done in time despite how extra load the academic writing assignments appear. Additionally remember that claims requiring meticulous records always turn out successful!

Common Scenarios for Mileage Reimbursement

There are numerous cases that the workers might encounter in which reimbursement for mileage is applicable. Below are examples of usual situations where one may be required to seek reimbursement for mileage:

- Traveling to client meetings: If you drive to meet clients or customers, you should be reimbursed for those miles.

- Running work-related errands: Trips to pick up supplies, drop off documents, or attend training sessions may qualify for reimbursement.

- Remote work travel: If you work from home but need to visit the office or another work location, those miles can also be claimed.

- Business trips: If your job requires travel to other cities or states, keep track of your mileage for reimbursement.

Yet different rules may apply so always cross-check any specified policies by your company. While knowing some of the common incidences that qualify for reimbursement helps you ensure none of your payments are left out!

Employee Rights Under Massachusetts Law

It is important for every employee in Massachusetts to have an understanding of their rights on mileage reimbursement. The law aims at safeguarding against unfairness wherein workers are not asked to pay for travel expenses incurred while using own automobiles for official tasks. Key rights that all employees need to know:

- Right to reimbursement: If you use your personal vehicle for business, you have the right to be reimbursed for your mileage.

- Protection against retaliation: Your employer cannot retaliate against you for requesting reimbursement or for any complaints regarding unpaid mileage.

- Clear policies: Employers are required to provide clear mileage reimbursement policies. This helps you understand how to claim your miles effectively.

- Access to records: You have the right to access any documentation related to your mileage reimbursement claims, ensuring transparency in the process.

If you believe your rights have been infringed upon, it might be worthwhile engaging your HR department or getting in touch with an attorney. Being aware of one’s rights enables a person to stand up for justice.

Employer Responsibilities for Reimbursement

In Massachusetts, the responsibilities of employers regarding mileage reimbursement are definite. Knowing these obligations ensures fair payment to employees for driving that is work-related. The following are the essential obligations that should be followed by employers:

- Clear reimbursement policy: Employers must provide a clear and detailed mileage reimbursement policy. This includes the rate of reimbursement, eligible trips, and documentation requirements.

- Timely payments: Employers are required to process reimbursement requests promptly. Employees should receive their payments in a reasonable timeframe after submitting their claims.

- Record keeping: Employers must maintain accurate records of mileage reimbursements. This includes tracking submitted claims and payments made to employees.

- Training and communication: It’s essential for employers to communicate their policies effectively and provide training if necessary. Employees should know how to claim their mileage without confusion.

Massachusetts law is complied with by employers to not only fulfill these responsibilities but also cultivate a positive work environment for their workers.

Steps to Take if Reimbursement is Denied

It can be really annoying to get denied on mileage reimbursement. However there steps that can be taken to heal the situation. Here is a guide on how to react when your claim gets rejected:

- Review the denial: Understand why your claim was denied. Check if it was due to missing documentation, incorrect mileage, or a policy misunderstanding.

- Gather your records: Collect all relevant documents, including your mileage log, receipts, and any previous communication regarding your claim.

- Speak to your supervisor: Discuss the denial with your immediate supervisor or manager. Sometimes, they can provide clarity or rectify the situation directly.

- Contact HR: If the issue persists, reach out to your human resources department. They can help mediate the situation and ensure your rights are protected.

- File a formal complaint: If all else fails, consider filing a formal complaint with your company. You may also explore legal options, especially if you believe your rights have been violated.

Just keep in mind, being orderly and anticipating events can immensely enhance your possibilities of receiving the compensation that you merit.

Frequently Asked Questions about Mileage Reimbursement

Employees often have inquiries about mileage reimbursement. Below are common questions that may assist in clarifying some of these issues:

- What qualifies for mileage reimbursement? Generally, any business-related travel using your personal vehicle qualifies, including meetings, errands, and trips to clients.

- How is the reimbursement rate determined? The reimbursement rate is often based on the IRS standard mileage rate, which may change yearly. Check for updates regularly.

- Do I need to submit receipts? While you don’t usually need to submit gas receipts for mileage, keeping them for other expenses like tolls is wise.

- Can I claim mileage for commuting? Unfortunately, commuting between your home and regular work location is not typically reimbursable. However, trips from a temporary work location may qualify.

- What if my employer doesn’t have a mileage reimbursement policy? If your employer lacks a clear policy, it’s essential to ask for one. You can also consult Massachusetts state law for guidance.

More questions or concerns should be directed to either HR department representatives for guidance or legal advisors who provide help in understanding your rights with respect to being reimbursed for distance traveled by car.

Conclusion on Massachusetts Mileage Reimbursement Law

To conclude, Massachusetts mileage reimbursement statute is important to both workers and businesses. Business travel by employees must be reimbursed for them while documenting regarding these expenses is crucial. Preceding this, employers ought to embrace definite policies and settle reimbursements punctually. Open communication lines must be established by the two parties so as to facilitate an unbiased and transparent reimbursement process. If there are inquiries concerning your rights or oblations contact your HR department or consult with a legal counselor. Keeping yourself updated will save you from risks as well as creating a good working place.