What You Need to Know About Nevada Business Regulations

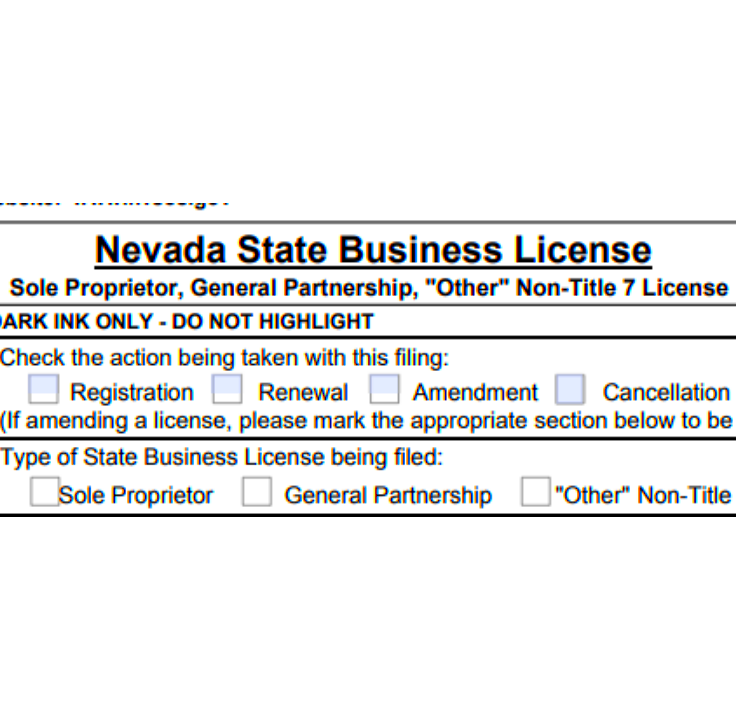

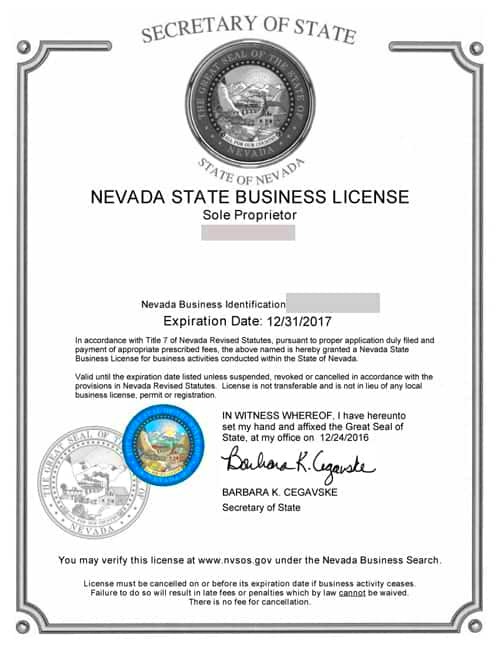

The business licensing is the first thing to get right when starting a business in Nevada, and it can be exciting. Penalties can await you for not following the right steps because Nevada is serious about its business licensing. Regardless of what type, every kind of business must have state business license as their legal operating document so they comply with Nevada law.

Here’s a breakdown of the key steps in license acquisition:

- State Business License: Almost every business in Nevada must apply for this. It’s renewed annually and can be done online.

- Local Business License: Depending on where you plan to operate (Las Vegas, Reno, etc.), you might need an additional local license.

- Special Permits: Certain industries, like liquor or food services, may require extra permits.

In addition to these essentials, certain firms will require particular permits that are profession-related. In this light, real estate agents, builders (contractors) and healthcare practitioners must comply with extra regulatory boards. It should however be noted that price for licensure is dependent on region hence it becomes necessary to make provision for such expenditures in one’s budget.

How Zoning Laws Affect Businesses in Nevada

It may seem that zoning regulations are uninteresting; however, they are an essential component of doing business in Nevada. Each state has its own city and county zoning laws that designate locations for businesses. To separate residential from commercial or industrial zones, these laws aim at keeping everything organized.

Here are the zoning classifications in Nevada:

- Residential Zones: Typically, businesses can’t operate here unless they have specific home-based business permits.

- Commercial Zones: These are areas designed for businesses like retail stores, restaurants, and offices.

- Industrial Zones: This is where factories or large-scale production facilities are located.

Before starting a business, make sure you find a proper location. It may also require consulting the municipal planning unit in order to establish if your business type is permitted in that area.

heft fines can accrue as the grand consequence of breaking up the zoning rules or even closing down your business; perform some research in advance to save yourself from much trouble later on.

Employment Regulations That Nevada Businesses Must Follow

You are knowledgeable about state employment laws as a business person in Nevada. These regulations deal with anything from minimum wage to overtime pay and workers’ rights. The rules here are stricter than those found in many other states; thus, it is imperative to follow them closely.

Key provisions for employment involve:

- Minimum Wage: Nevada has a two-tiered minimum wage system. The wage depends on whether the employer offers health benefits.

- Overtime: Employees who work over 40 hours a week must be compensated at 1.5 times their hourly rate.

- Breaks and Meal Periods: Employees working eight hours or more must be given a 30-minute unpaid meal break and 10-minute paid rest breaks.

- Paid Leave: Nevada businesses with 50 or more employees must offer paid leave, which can be used for any purpose.

Nevada is an “at-will” employment state, which is significant. This states that the relationship may be broken by both parties at any given moment, and this results into termination of the contract by either the employer or employee. Nevertheless, it should be noted that such termination must not only be without reason but also not discriminatory or retaliatory in nature.

Knowledge of these employment regulations will enable you to remain compliant while creating a working environment that is not biased against your workers.

Compliance with Nevada Tax Laws for Businesses

While devoid of personal or corporate income tax, when it comes to taxation, Nevada distinguishes itself from other states. However, this does not imply that businesses are excluded from taxation. For this reason, fines or other penalties could be imposed on failing to comply with certain taxes that are applicable in the State of Nevada.

Including but not limited to, taxes that need consideration when doing business in Nevada include:

- Commerce Tax: This is for businesses with gross revenues exceeding $4 million annually. The rate varies depending on the industry, and it’s due each fiscal year.

- Modified Business Tax (MBT): If you have employees, you’re required to pay this payroll tax. It’s calculated based on your total wages after deducting employee health benefits.

- Sales and Use Tax: Businesses selling goods or providing certain services must collect and remit sales tax. This varies by county but usually hovers around 8.375% in Nevada.

Even if they don’t have to pay taxes on their business profits or franchise operations compliance with these tax obligations is still required. Thanks to Nevada Department of Taxation that allows most submissions online, filing has been simplified to some extent. Ensure that you keep everything in order including sales and payroll taxes to prevent having a rough time during tax season.

Environmental Regulations for Nevada Businesses

Initially, I have to acknowledge that this state is diverse in natural settings which cause some unregulated memories like these diverse ecosystems. Different industries will be having different laws ranging from air quality to water usage and even waste management.

Below are some of the essential environmental regulations that every business in Nevada needs to be aware of.

- Air Quality Permits: If your business releases emissions (e.g., factories, construction sites), you may need a permit from the Nevada Division of Environmental Protection (NDEP).

- Water Permits: Businesses involved in water use, whether for agriculture or industrial purposes, need to comply with water quality regulations. This includes monitoring wastewater discharge to prevent pollution.

- Waste Management: Proper disposal of hazardous waste is a priority. Businesses must follow guidelines for disposal and recycling to avoid contaminating landfills or groundwater.

In Nevada there are many incentives to help businesses adopt sustainable practices such as energy efficiency programs and renewable energy grants. Not only does taking an active role in environmental compliance help the environment but it also saves your company from being fined heavily.

How Nevada’s Consumer Protection Laws Impact Businesses

In Nevada, it is essential for businesses to be aware of their treatment of customers. The state boasts stringent consumer protection statutes aimed at ensuring fairness and ethical conduct by enterprises. They span through several areas such as marketing, product safety and fraud avoidance measures.

Here’s a fast glance at several of the vital protection policies for buyers:

- Truth in Advertising: Businesses must ensure that their advertisements are not misleading or false. This includes accurate pricing and claims about products or services.

- Product Safety: Nevada enforces strict product safety standards. Selling defective or dangerous products can result in recalls and lawsuits.

- Refund and Return Policies: Clear and fair return policies are required by law. This ensures customers can easily return faulty goods within a reasonable timeframe.

- Fraud and Deceptive Practices: Nevada’s laws protect consumers from fraudulent schemes, including hidden fees and unauthorized charges. Businesses must be transparent in all their dealings with customers.

Undergoing heavy penalties, lawsuits, and harms to one’s reputation are some of the consequences that could arise from contravening consumer protection laws. This means that it is vital for a business to maintain transparency and honesty in practice so as to attract consumer confidence while sidestepping court actions.

Penalties for Non-Compliance with Nevada Business Laws

It is important to follow business regulations in Nevada, however, there can be dire consequences if one fails to do so. Not adhering to them can result in hefty fines which will affect both your pocket as well as your company. Although they are dependent on what you did or did not do, the repercussions are usually harsh.

For your consideration, here is a detailed list of possible consequences:

- Fines: Many regulatory bodies impose monetary fines for violations. For instance, failing to obtain the required licenses could result in fines ranging from hundreds to thousands of dollars.

- License Revocation: Serious or repeated violations can lead to the revocation of your business license. This can halt your operations until compliance is achieved.

- Civil Penalties: Depending on the offense, you may be subject to civil lawsuits from consumers or other businesses, leading to further financial liabilities.

- Injunctions: In some cases, courts may issue injunctions to prevent you from continuing certain business practices deemed illegal.

Proactive and informed approach towards compliance is necessary to evade these sanctions. Carrying out routine audits, training staff, and seeking advice from legal professionals would help your company follow state regulations. Always bear in mind that it is better to prevent than to cure!

Frequently Asked Questions About Nevada Business Regulations

Most entrepreneurs are worried about the same business rules in Nevada. Here are some of the frequently asked queries that may help to clarify some doubts:

- Do I need a state business license? Yes, almost all businesses in Nevada require a state business license, renewed annually.

- What are the zoning requirements for my business? Zoning laws vary by location, so it’s essential to check with your local government to ensure your business activities comply.

- How often do I need to pay taxes? Nevada businesses typically have various tax obligations, including the Commerce Tax and Modified Business Tax, which may require quarterly or annual payments.

- What if I don’t comply with environmental regulations? Non-compliance can lead to fines, permit revocation, and legal action, so it’s crucial to understand and follow these regulations.

More targeted inquiries may be addressed by speaking with a local lawyer or business consultant who can provide personal help depending on your situation.

Final Thoughts on Navigating Nevada Business Regulations

Getting to know and doing what is necessary under the laws of Nevada on a business may look frightening; however, it is needed for successfulness. Your operations as a business person entail the need for licensing and tax payments as well as rules to take care of customers.

A Few Last Recommendations to Remember:

- Stay Informed: Regulations can change, so regularly check for updates to ensure your business remains compliant.

- Seek Professional Help: Don’t hesitate to consult with legal or financial experts. Their insights can save you from potential pitfalls.

- Document Everything: Maintain thorough records of your licenses, permits, and tax filings. This documentation can be invaluable in case of audits.

- Engage with the Community: Networking with other business owners can provide insights and support in navigating the regulatory landscape.

Moreover, you’d be able to lay down a strong basis for your venture in Nevada by following these measures. It’s important to note that compliance doesn’t only revolve around avoiding sanctions; but rather establishing confidence and respectability within your locality!